You might think bookkeeping is boring.

You’re probably right.

However, do you know what’s worse than something that’s boring?

Your business failing because you weren’t on top of your finances. Or even worse, losing money because you simply didn’t keep track of the dough. (Psst, have you tried a budget app to keep track of things?)

This happened to Ben Brown.

After launching his Shopify store, Ben received plenty of orders: “It started off good (at least, I thought so!) … It wasn’t until I sent off all the orders that I realized my mistake: I’d miscalculated the shipping cost.”

He worried shoppers might abandon their carts once they saw the post and packaging costs, so he offered free shipping on all of his products.

“Once I’d paid my carrier for delivery, I actually lost money,” he says.

*Whoops*

Thankfully Ben recovered. But wouldn’t you prefer to avoid disastrous situations like this in your business?

With some basic bookkeeping knowledge, you can easily monitor how your business is performing, avoid mistakes, and make informed changes to improve it.

In this article, you’ll learn all about bookkeeping and bookkeeping tools.

Let’s dive in!

Post Contents

Don’t wait for someone else to do it. Hire yourself and start calling the shots.

Get Started FreeWhat Is Bookkeeping?

Bookkeeping is the process of recording and organizing financial data on a regular basis. This could be for an individual, business, or any other type of organization. It ensures that financial information is comprehensive, up to date, and accessible.

Bookkeeping includes activities like:

- Recording sales and tracking invoices.

- Monitoring accounts receivable.

- Billing clients for goods sold or services provided.

- Verifying and recording invoices from suppliers.

- Paying supplier invoices.

- Prepare employee payroll and processing governmental reports.

- Recording depreciation.

- Producing accurate financial reports.

Today, most bookkeepers use online software.

But bookkeeping still requires an understanding of basic financial accounting.

Why is Bookkeeping Important?

Nicole Fende, the author of How to be a Finance Rock Star, said, “Many small businesses would rather face an angry barbarian horde than tackle their cash flow statement.”

This might even be you.

However, “no matter what business you’re in, the ability to understand your books is essential,” says Lita Epstein, author of Bookkeeping Kit For Dummies.

Small business owners are often great at landing new customers or creating new products or services, but many fail to keep track of the fundamental financials.

That’s when things go south.

Businesses who lack financial clarity will often run into cash flow problems, rack up huge amounts of debt, forget to invoice customers, or pay bills late and incur fines.

Scott Scharf, the founder of Catching Clouds, an accounting service for ecommerce businesses, reveals that most of his customers don’t know whether they’re profitable.

“They’re not quite sure, and there’s a big difference between the cash in the bank and whether your business is profitable or not. They just don’t know where they stand, and so there’s a lot of stress related to not knowing.”

Staying on top of your finances is crucial for long-term business success.

“When you take the time to learn how to read and understand your books, you’ll have an excellent gauge of how well you’re doing,” says Lita Epstein.

“It also provides you with lots of information throughout the year so you can test the financial success of your business strategies and make course corrections early in the year if necessary to ensure that you reach your year-end profit goals.”

Sold? Okay, next up:

What do Bookkeepers Actually Do?

Bookkeepers use many of the same financial recording methods as accountants. These include collecting, organizing, and tracking receipts, invoices, and other transaction details.

Today, most bookkeepers use accounting software to track and make sense of the numbers. (Stick around to learn about three of the best online accounting software tools.)

But this isn’t all bookkeepers do.

Professional bookkeepers are also responsible for a whole set of tasks on top of simple data input. They’re highly skilled in financial accounting software and should be able to:

- Train members of your team to use business accounting software to ensure every transaction is correctly accounted for.

- Resolve problems, mistakes, and confusion that arise in the financial side of the business.

- Improve your business’ financial workflow, such as adding point-of-sale (POS) tools.

- Streamline your payroll services to improve the way that you pay your employees.

- Track interest, investments, and asset depreciation.

- Set money aside for taxes.

- Follow up invoices, and chase debtors for payment.

- Prepare financial records for your accountant when tax season looms.

- And more!

Bottom-line: Bookkeepers keep your business finances running smoothly so that you can focus on serving customers and growing the bottom-line.

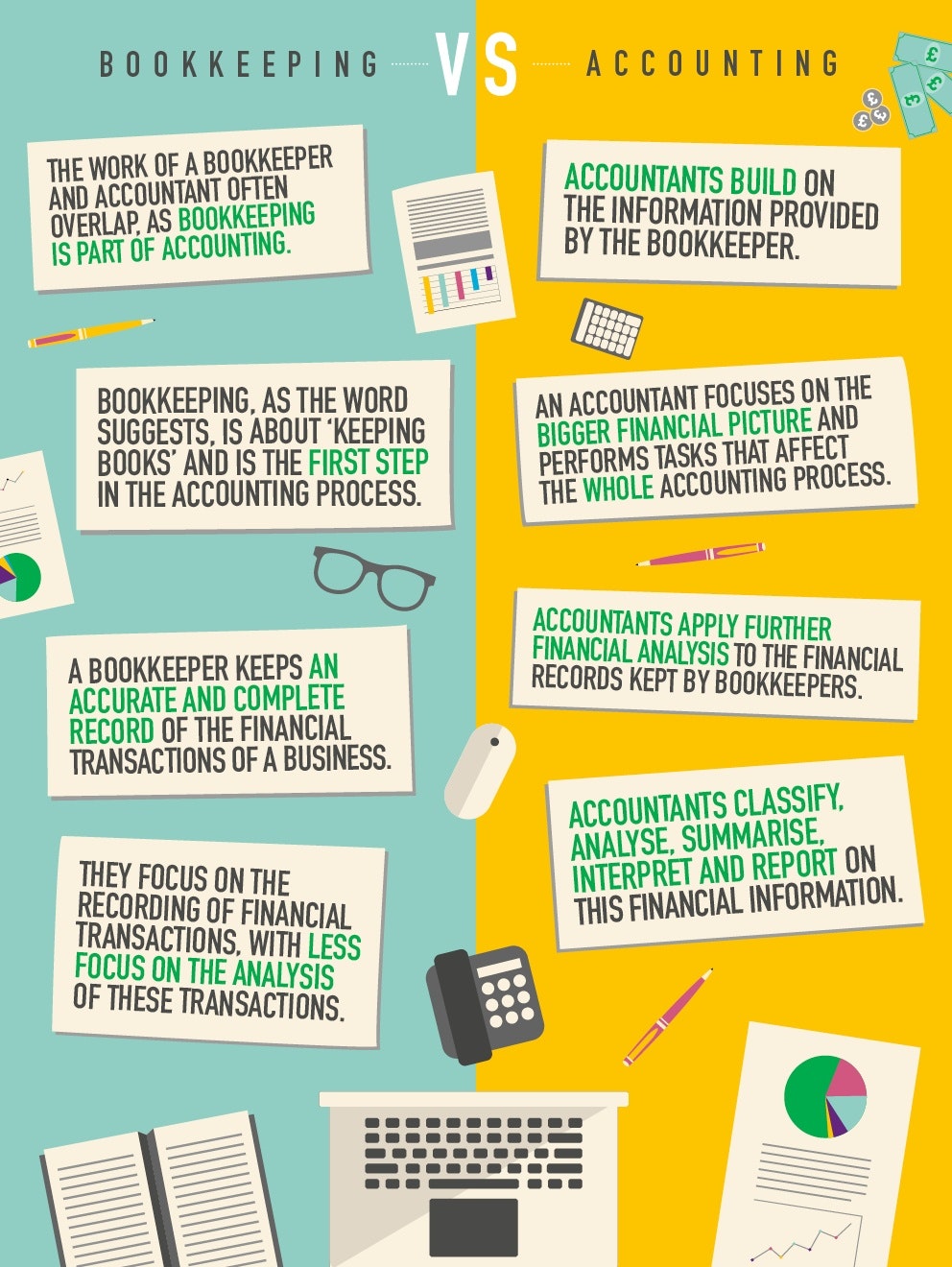

Bookkeeping vs. Accounting

If you’re a small business owner, you might be wondering if you need to get a bookkeeper or an accountant – or both.

And now that you understand the need for bookkeeping, you might be wondering, “How does it differ from accounting?”

Good question.

The words “bookkeeper” and “accountant” are often used interchangeably. However, there are some key differences that determine the main responsibilities of each role.

Bookkeeping is a Subset of Accounting

An accountant, professional bookkeeper, or an employee of the business can do your bookkeeping.

If you’ve just started a business, chances are you’ll be doing the bookkeeping yourself.

This is no bad thing. When launching a new business venture, it’s crucial that you have an intimate grasp of your financial situation. What better way than to do the bookkeeping yourself?

Essentially, bookkeepers take care of the day-to-day financial work.

They keep detailed and accurate financial accounts and use this financial clarity to help make informed business decisions.

Accountants are Financial Experts

Accountants are usually qualified, registered members of a statutory association. So they often have titles like CPA (Certified Public Accountant) or CA (Chartered Accountants).

That’s how they can charge the big bucks.

These experts will use the accounts provided by the bookkeeper. They focus on analyzing the transactions to provide financial advice.

They’ll also use the information in the accounts to file tax returns and other reports.

Whereas bookkeepers handle the day-to-day financial tasks, accountants often step in on a quarterly basis to provide advice and make adjustments.

The infographic below summarizes bookkeeping vs. accounting:

8 Vital Bookkeeping Accounts

Now that you understand the need for bookkeeping and how it relates to accounting, let’s talk about the different accounts bookkeepers keep.

“Each and every account has its purpose in bookkeeping, but all accounts certainly aren’t created equal,” says Epstein. “For most companies, some accounts are more essential than others.”

To gain a solid understanding of your financial situation, it’s important to understand the different accounts that your bookkeeper will use. This will enable you to make better decisions and increase the efficiency of the business.

Below is a quick summary of eight vital bookkeeping accounts, as outlined by Epstein in Bookkeeping for Dummies.

1. Cash

All business transactions should pass through the cash account. In fact, this is so important, bookkeepers will often use two journals to track the activity (Cash Receipts and Cash Disbursements).

All cash coming in or going out must be recorded properly in the cash account.

2. Sales

Ah, sales — everyone’s favorite account.

This account is where you keep track of all incoming revenue from sales of your products or services.

Epstein notes that, “Recording sales in a timely and accurate manner is a critical job because otherwise, you can’t know how much revenue has been collected every day.”

3. Accounts Receivable

This is the account you use to track all money due from customers.

“Keeping Accounts Receivable up-to-date is critical to be sure that you send timely and accurate bills to customers,” writes Epstein.

It’s especially important if you sell products or services on credit.

To avoid cash flow problems, it’s imperative to know when you can expect to receive money owed to you. Plus, you don’t want to forget to collect money you’re owed!

4. Inventory

If you don’t know how much stock you have, you’re in big trouble, my friend.

So you must account for and track your inventory meticulously.

“Your bookkeeper contributes to this process by keeping accurate inventory records in an Inventory account,” writes Epstein. “The numbers you have in your books are periodically tested by doing physical counts of the inventory on hand.”

5. Accounts Payable

This account tracks the bills you need to pay.

Epstein notes that you “want to make sure you pay bills on time,” as not doing so will likely land you in hot water.

“Suppliers often penalize late-paying companies by cutting them off or putting them on cash-only accounts. On the flip side, if you pay your bills early, you may be able to get discounts and save money with suppliers.”

6. Office Expenses

“These expenses tend to creep up if they aren’t carefully monitored in the Office Expenses account,” says Epstein.

As Benjamin Franklin said, “Beware of little expenses. A small leak will sink a great ship.”

Depending on the type of business you run, this may also include office utility bills and rent, travel expenses, and entertainment expenses.

7. Payroll Expenses

Staff wages are often a business’ largest expense. Plus, employees won’t take kindly to being paid late or less than they’re owed.

“Accurate maintenance of this account is essential because it ensures that all governmental reports are filed and payroll taxes are paid,” according to Epstein. “And if you don’t take care of these responsibilities to the government, you’ll find yourself in some serious hot water.”

8. Retained Earnings

Use this account to track profits reinvested into the business.

“This account is cumulative, which means it shows a running total of earnings that have been retained since the company opened its doors,” notes Epstein.

The account is especially important to investors and lenders who need to track how the company is performing.

Other Bookkeeping Accounts Used

There are many other accounts that bookkeepers use, depending on the individual needs of the business. They include:

- Purchases

- Loans Payable

- Owners’ Equity

- Capital Accounts

- Drawing Account

- Purchases

Next up:

How to Do Bookkeeping: 3 Essential Tips to Remember

Having identified what bookkeeping is, and many of the accounts that are used, here are three essential tips to effective bookkeeping.

1. Keep Track of Absolutely Everything

And I mean, everything.

Noting all transactions allows you to keep comprehensive accounts in order to glean those essential financial insights. These will help you make effective strategic decisions.

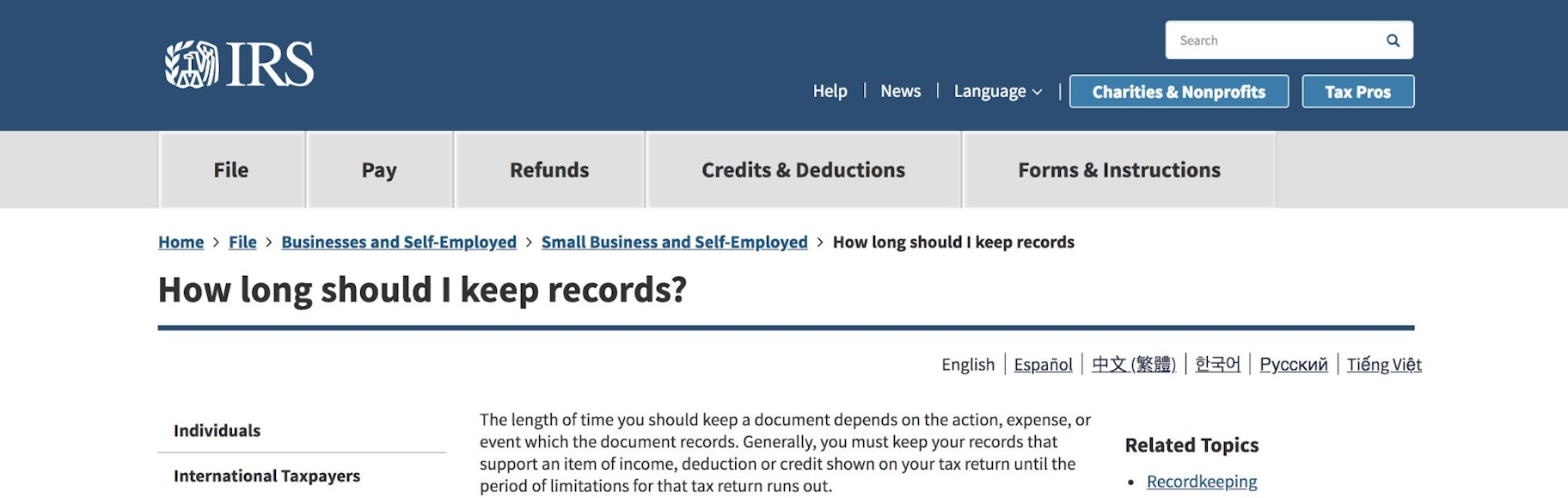

What’s more, if you retain proof of your transactions and are audited or taken to court, you’ll have concrete evidence that you’ve done no wrong.

Plus, in the U.S., the IRS requires businesses to keep records of all transactions for up to 7 years.

2. All Money Should Flow Through the Business Account or Petty Cash

If you don’t do this, things will get complicated – fast.

You might forget to record money received or spent. Or, you simply won’t have the proof of the transaction should you need it.

Neither is good.

Pay any money you receive directly into your business account or petty cash account before you spend it.

3. Always Keep Business and Personal Finances Separate

This is a no-brainer, but it can be easier said than done for small businesses or freelancers.

If you’re using a bank account for business and personal use, you may be tempted to spend money that you need for upcoming outgoings.

Plus, personal purchases might get confused with business expenses.

The best thing to do is to have completely separate accounts for your business transactions. Then, simply transfer money into your personal account (as wages) to make personal purchases.

This will keep your account transactions tidy and easy to understand.

Now let’s look at some tools.

Digital Bookkeeping Tools

There are many bookkeeping and accounting tools available online.

These tools make managing your organization’s finances easier, and you can gain valuable insights in just a few clicks.

Let’s take a look at three of the leading accounting and bookkeeping tools.

1. Wave

Recommended for: Small businesses on a tight budget.

Cost: Free.

With over 2 million users in over 200 different countries, Wave is one of the best free accounting software solutions available.

What’s more, unlike many other programs, Wave imposes no limits on how many invoices, estimates, customers, reports, etc., that you can use. Plus, the software even allows you to manage multiple small businesses.

It’s also simple to set up, and Wave University is particularly helpful when you get stuck. Although the software is free, you can upgrade to a paid account to access premium customer support features.

The software supports multiple currencies and integrates with PayPal, Stripe, and more. Plus, there are mobile apps for Android and Apple devices.

In other words, it’s totally free and has great features.

#Win

The software is designed for small businesses. So if you’re running a larger company, you might find Wave lacking in more advanced features and capabilities.

However, Wave is a great choice if you’re just starting out.

2. Quickbooks

Recommended for: Established small businesses who have particular requirements.

Price: 30-day free trial, then $5 to $30 per month.

Quickbooks was created by Intuit, which was founded in 1983 and has dominated accounting and personal finance for over three decades.

This accounting software is one of the most popular online with over 2.2 million users.

Quickbooks provides an incredible range of features. These include double-entry accounting, abundant reporting options, customizable invoices, payroll support, multiple currencies, and more.

Plus, Quickbooks integrates with over 200 services, such as Shopify and PayPal.

There’s a handful of different plans and optional feature add-ons. This makes it easy to select and pay for the specific features you need.

Quickbooks also provides two handy mobile apps for convenience.

Plus, the software allows you to connect to your bank account. This adds your account activity to your Quickbooks account automatically.

Quickbooks is perfect for established freelancers and small businesses who want an intuitive and advanced accounting tool.

3. Xero

Recommended for: Established businesses who want to keep things simple.

Price: 30-day free trial, then $9 to $70 per month.

Xero is another incredible online accounting software service.

In only 10 years the company has established offices all over the world and attracted 1 million users in over 180 countries.

Plus, Forbes named Xero the “#1 Innovative Growth Company.” Twice.

It doesn’t match the range of features that Quickbooks has. But Xero is very intuitive to use and fully lives up to its motto, “Beautiful Accounting Software.”

It’s equipped with all the vital features and works with over 160 currencies.

In particular, the inventory tracking feature and the ability to create purchase orders makes this software ideal for ecommerce businesses.

Xero also integrates directly with Shopify, as well as tons of other apps like PayPal and Stripe. Plus, there’s a mobile app which allows you to log expenses and other info while on the go.

This accounting software is perfect for established businesses who want professional accounting software that’s simple to use.

4. FreeAgent

Recommended for: Small businesses that require a low-cost accounting software.

Price: $10 /month for 6 months, then just $20 /month (all accounts start with a free 30-day trial.)

FreeAgent is another great accounting software that simplifies your bookkeeping for you. It doesn’t do the work for you, but allows you to be in charge of it yourself.

You can add multiple projects, multi-currency invoices, unlimited users and clients, and setup sales tax easily. It also connects with your bank accounts and allows you to track your expenses or send invoices and monitor cash flow.

Ideally, this bookkeeping tool is best for small businesses of up to 10 employees.

Summary: Bookkeeping for Your Online Business

Bookkeeping is crucial to long-term financial success.

Without it, you could make unnecessary mistakes that could spell disaster for your business.

Simply staying on top of your finances will provide you with invaluable insights into the inner workings of your business. These will allow you to make informed decisions that will help you to grow your bottom line.

Who handles the bookkeeping in your business, yourself, an employee, or a contractor? Let us know in the comments below!