Rich Dad Poor Dad is Robert Kiyosaki’s best-selling book about the difference in mindset between the poor, middle class, and rich. In this Rich Dad Poor Dad book summary, we’ll break down some of the best lessons Kiyosaki shares to help you become more financially literate. So, let’s dive in.

Post Contents

- 20 Years… 20/20 Hindsight

- Introduction

- Chapter One: Lesson 1: The Rich Don’t Work For Money

- Chapter Two: Lesson 2: Why Teach Financial Literacy?

- Chapter Three: Lesson 3: Mind Your Own Business

- Chapter Four: Lesson 4: The History of Taxes And The Power of Corporations

- Chapter Five: Lesson 5: The Rich Invent Money

- Chapter Six: Lesson 6: Work to Learn – Don’t Work For Money

- Chapter Seven: Overcoming Obstacles

- Chapter Eight: Getting Started

- Chapter Nine: Still Want More? Here Are Some To Do’s

- Final Thoughts

Don’t wait for someone else to do it. Hire yourself and start calling the shots.

Get Started Free20 Years… 20/20 Hindsight

Rich Dad’s Lesson 1: “The rich don’t work for money.”

In today’s world, there’s never been a more significant divide between the rich and all other income classes. Some economists in California even noticed that about 95% of income gains between 2009-2012 went to the wealthiest people in the world– the one percent. Thus, showing that the biggest increases in income go to entrepreneurs and investors– not employees.

Rich Dad Lesson: “Savers are losers.”

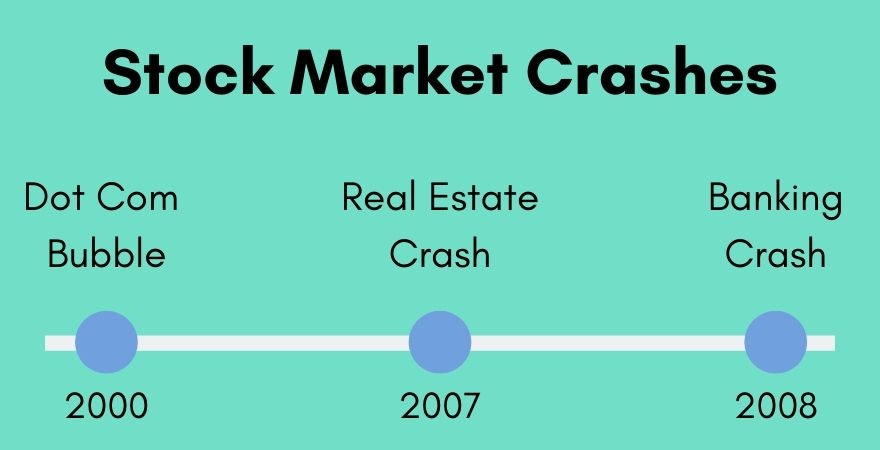

The emphasis on saving is only found in the poor and middle class. However, the reason why savers are losers is that since 2000 there have been three massive stock market crashes.

- Dotcom Crash: 2000.

- Real Estate Crash: 2007

- Banking Crash: 2008

The first three crashes of the 21st century pale in comparison to the great crash of 1929. When you look at the data visually, you can see how big of an impact the crashes were.

Notably, after each stock market crash, the American government and the Federal Reserve Bank started “printing money.”

Today’s interest rates are relatively close to zero, which is what makes savers losers. And the biggest savers are the poor and middle class.

Rich Dad Lesson: “Your house is not an asset.”

When Robert Kiyosaki first published Rich Dad, Poor Dad in 1997, every publisher who had rejected his book had criticized the lesson regarding a person’s house not being an asset. Historically, people believed that your home was the biggest investment you can make.

However, it wasn’t until 2007 when “subprime borrowers began to default on their subprime mortgages,” that people realized that a house wasn’t an asset.

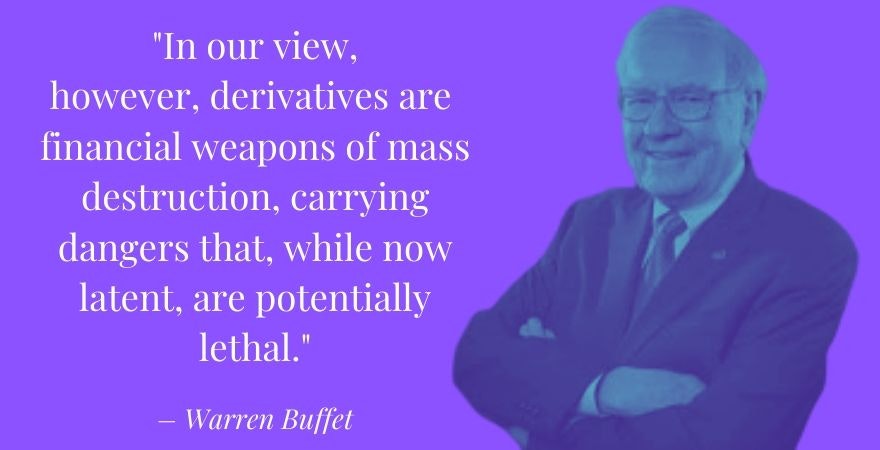

The real estate crash was caused by the rich, not the poor. “The rich created financially-engineered products known as derivatives.” Even Warren Buffett hated these, calling them “weapons of mass financial destruction.” The derivatives were the cause of the housing market collapse. Yet, somehow, the poor were blamed even though there were approximately $700 trillion in financial derivatives. Believe it or not, but that number has since exploded to $1.2 quadrillion in financial derivatives.

Rich Dad Lesson: “Why the rich pay less in taxes.”

Poor people often get angry when they learn rich people pay less in taxes. Instead, they should focus on learning from the rich as they pay fewer taxes legally.

The poor and middle class will always pay more taxes than the rich. This statement is true because it’ll always be the person who works for money who gets taxed the most.

When presidents promise to raise taxes on the rich, they typically mean the middle class. Not the real rich.

Introduction

Robert Kiyosaki had two fathers: a rich one and a poor one. One was highly educated with a Ph.D. and so intelligent he completed his undergraduate degree in only two years. The other father didn’t even finish the eighth grade. While both men worked hard, were successful, and earned a lot of money, there was always one who struggled with money. And the other dad, well, he became one of the richest people in Hawaii.

By having two dads, with entirely different mindsets, Kiyosaki found himself comparing the two dads a lot. It was hard to figure out which dad he should listen to. Neither had found success yet. And both were experiencing financial struggles as they were still early in their careers.

Schools don’t provide financial education. Thus, causing the poor and middle class to be in debt. If millions of people need financial or medical assistance, Medicare and Social Security may run out.

Transitioning from the mindset of “I can’t afford it” to “How can I afford it?” forces you to think instead of letting yourself off the hook.

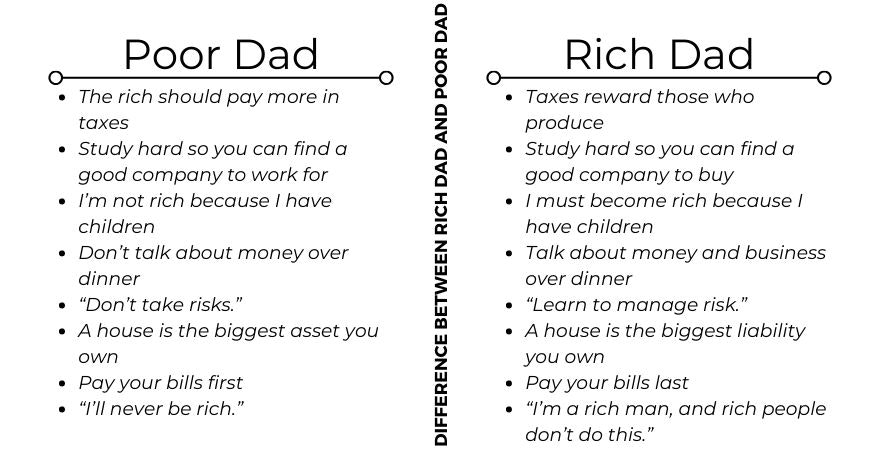

Poor Dad: The rich should pay more in taxes

Rich Dad: Taxes reward those who produce

Poor Dad: Study hard so you can find a good company to work for

Rich Dad: Study hard so you can find a good company to buy

Poor Dad: I’m not rich because I have children

Rich Dad: I must become rich because I have children

Poor Dad: Don’t talk about money over dinner

Rich Dad: Talk about money and business over dinner

Poor Dad: “Don’t take risks.”

Rich Dad: “Learn to manage risk.”

Poor Dad: A house is the biggest asset you own

Rich Dad: A house is a liability

Poor Dad: Pay your bills first

Rich Dad: Pay your bills last

Poor Dad: struggles to save a few dollars

Rich Dad: creates investments

Poor Dad: teaches how to write a strong resume

Rich Dad: teaches how to write a strong business and financial plan

Poor Dad: “I’ll never be rich.”

Rich Dad: “I’m a rich man, and rich people don’t do this.”

Chapter One: Lesson 1: The Rich Don’t Work For Money

“The poor and middle-class work for money. The rich have money work for them.”

Growing up, Robert Kiyosaki went to the same school as the rich kids, simply because he lived on a different side of the street. Being poor, in a school filled with affluent students, made him seek an answer to the question, “how do I make money?”

His best friend Mike was also poor, and so a friendship was struck between the two. The two spent an entire morning one Saturday brainstorming all the ways they could make money. Their first project wasn’t a success, nor was it legal. They decided to cast nickels out of lead to make money– literally. With a quick explanation of the laws of counterfeiting from Robert Kiyosaki’s poor dad, the pair went back to the drawing board.

Robert Kiyosaki’s poor dad suggested that the two learn how to make money from Mike’s dad (Robert Kiyosaki’s rich dad). Poor dad had heard from his banker how good the rich dad is at making money. Mike arranged a meeting time, and the two began their lessons.

Robert Kiyosaki arrived at 8 o’clock sharp for his meeting with Mike’s dad. When the meeting began, the rich dad told the two that he’d be happy to teach them but won’t be doing it in a classroom style. He proposed that the two boys work for him so that he can teach them faster. The two weren’t allowed to ask questions about the deal. And so the first lesson was learned: opportunities are fleeting, so you need to jump on them when they arrive. He offered to pay Robert and Mike 10 cents an hour, for three hours, every Saturday.

After a couple of weeks doing excruciatingly boring work, Robert told Mike that he wanted to quit. This response is what Mike’s dad was hoping for.

Before his meeting with his rich dad, Robert Kiyosaki’s poor dad told him to demand what he deserves at least 25 cents an hour and to quit his job immediately if he didn’t get a raise. Robert went to meet with his rich dad but was forced to wait 60 minutes longer than expected, which infuriated him. Robert felt that his rich dad hadn’t kept his end of the bargain of teaching him and that he was just trying to exploit him by making him work for him.

His rich dad noticed that Robert had sounded like his employees after only one month. Rich dad insisted that he was teaching Robert, but in a way that life teaches, not in the way that school does. The most effective way to learn is by doing, though most people consume education from books, which is the least effective way.

The main lesson he taught in the office that day was that Robert could either end up like his employees who blame others for his problems, or he could take another path and become a wealthy man.

Rich dad had suggested that the two boys find a new way to make money outside of working for someone else.

Lesson 1: “The poor and middle-class work for money. The rich have money work for them.”

Rich dad also shared how happy he was that Robert Kiyosaki got angry. He said, “anger is a big part of the formula, for passion is anger and love combined.” Fear is what controls employees that causes them to exploit themselves.

Rich dad continued, “…it’s fear that keeps most people working at a job: the fear of not paying their bills, the fear of being fired, the fear of not having enough money, and the fear of starting over.”

Employees often feel disappointed looking at their paychecks– especially after tax and deductions. This was nine-year-old Robert’s first introduction to taxes. It’s also how he learned that the rich don’t let the government do that to them, even though they earn more.

In a new deal, rich dad negotiated that Robert continues working for him, but for free. For the next three weeks, Robert and Mike worked for their rich dad for free. Then, on the third Saturday, he took them out to a park for some ice cream. He decided to introduce him to the trap of the rat race. He did this by offering to pay them twenty-five cents an hour. They said no. Rich dad then offered a dollar an hour. They said no. Then, two dollars an hour. They said no. Then, five dollars an hour. And they once again said no. The boys knew that they couldn’t be bought. They were committed to becoming wealthy.

Rich dad later pointed out that poor people often say they’re not interested in money. Robert Kiyosaki thought back to the times his dad would say, “I’m not interested in money. I work because I love my job.” This is how poor people often cover themselves up.

It’s essential to not give in to your emotions, such as fear, so that you can prevent any quick reactions and think objectively about a situation. The reality is a job is merely a short-term solution to a long-term problem. Rich dad’s focus is on teaching the boys how to have a choice of thoughts instead of a knee-jerk reaction to things.

One of the most empowering lessons rich dad taught in this section of Rich Dad Poor Dad was to “keep using your brain, work for free, soon your mind will show you ways of making money far beyond what I could ever pay you. You will see things that other people never see. Most people never see these opportunities because they’re looking for money and security, so that’s all they get.”

This lesson inspired the two boys to find a new way to make money. On one Saturday, they noticed Mrs. Martin cutting off the cover of the comic books and throwing them into a cardboard box. Since they weren’t allowed to resell the comic books, they decided to create a library for a fee where other kids could come over to read as many comic books as they like between 2:30 p.m. and 4:30 p.m. every day after school for only 10 cents. This deal was a bargain for the other kids who might’ve spent 10 cents buying a comic book. Each week, they averaged around $9.50, while paying Mike’s sister one dollar a week to manage the library. After three months, a fight broke out in the library, and Mike’s dad advised them to shut down the business. But they did manage to learn how to make money work for them instead of working for money.

Chapter Two: Lesson 2: Why Teach Financial Literacy?

“It’s not how much money you make. It’s how much money you keep.”

Robert Kiyosaki retired at the age of 47. He still works, but for him and his wife, Kim, working is an option as their wealth will continue to grow automatically.

In this section of Rich Dad, Poor Dad, Robert Kiyosaki shares a simple story. In 1923, the greatest leaders and richest businessmen joined together for a meeting in Chicago. Twenty-five years later, nine of them had their life end in the following ways:

- Four died broke

- One went insane

- Two were released from prison

- Two committed suicide

This unfortunate turn was likely due to their lives being drastically affected by the 1929 stock market crash and the Great Depression.

The biggest financial lesson to learn is that it’s all about how much money you keep, not how much you make. And without financial literacy, you’ll lose your money soon.

Growing up, poor dad recommended that Robert read books while rich dad recommended that Robert master financial literacy. Robert shares, “If you are going to build the Empire State Building, the first thing you need to do is dig a deep hole and pour a strong foundation. If you are going to build a home in the suburbs, all you need to do is pour a six-inch slab of concrete. Most people, in their drive to get rich, are trying to build an Empire State Building on a six-inch slab.”

It’s vital to learn the subject of accounting if your long-term goal is to be rich – no matter how boring you think the topic is.

Rule #1: You must know the difference between an asset and a liability– and buy assets.

“Rich people acquire assets. The poor and middle class acquire liabilities they think are assets,” rich dad says.

The biggest challenge poor people have is knowing the difference between an asset and a liability. Knowing the difference between the two can help you become rich.

So, what’s the difference?

An asset puts money into your pocket. A liability takes money out of your pocket.

Assets add to your income. Liabilities add to your expenses. And the job of a poor person pays you an income that then covers your expenses. The job of a middle-class person pays you an income then pays down liabilities then pays expenses. However, for a rich person, their assets pay them an income. For example, their assets may give them rental income, dividends, interest, or royalties.

Here are a few examples of liabilities that the middle class own:

- Mortgage

- Car loans

- Credit card debt

- School loans

Here are a few examples of assets that rich people own:

- Real estate

- Stocks

- Bonds

- Notes

- Intellectual property

Many people who are poor or in the middle class often say, “I’m in debt, so I need to make more money.” However, getting money isn’t a problem. It’s the lack of financial literacy that’s the problem. So if they simply had more money, the problem might become worse. That’s why when people win the lottery or get a pay raise, they usually end up back in the same financial situation as they did before. If a person spends all they have, the pattern will continue every time they make money.

Professional success isn’t directly tied to academic success anymore. Most students leave their schools with limited financial literacy. Later in life, they find themselves struggling financially. What they need to know more than how to make money is how to manage their money. This skill is called financial aptitude. Most people learned how to work hard instead of how to make money work hard for them.

Taxes end up costing the poor and middle class in the long run. People often buy bigger homes to grow a family, and property tax rises. People’s salaries increase over time, and so social security tax also sees a rise. And before long, their liabilities column is filled up with a mortgage and credit-card debt. Thus, trapping them in the rat race.

The secret to knowing how to make money is simply about creating assets instead of liabilities.

Golden Rule: “He who has the gold makes the rules.”

“Most financial problems are caused by trying to keep up with the Joneses.” You might choose to buy a bigger house, work harder, or get a promotion or pay raise.

As teenagers, Mike and Robert would work with their rich dad. They studied how he held meetings with his bankers, attorneys, accountants, investors, so forth. Even though his rich dad had left school at 13, he was now directing some very educated people.

Rich dad regularly told the two teens, “An intelligent person hires people who are more intelligent than he is.”

As a teenager, Robert realized he had more financial literacy than his poor dad as he was able to keep books and spent a lot of time listening to bankers, tax accountants, real estate brokers, and others like them.

In this section of Rich Dad Poor Dad, Robert Kiyosaki shares that many people view their home as an asset. However, in many cases, the value of a home doesn’t always go up. Sometimes people buy million-dollar houses that would sell for far less. Retirees such as Kim’s parents had a strain on their budget when their property taxes increased to $1,000 a month.

When Robert plans on buying a bigger house, he “first buys assets that will generate the cash flow to pay for the house.” He shares that as you continue to grow your asset column, over time, you’ll also see the growth of your income. And that’s why the rich keep getting richer– however, the reason why the middle-class struggles are because taxes increase as their salaries increase.

Employees work for three key groups:

- Company: Making the owners and shareholders rich

- Government: Possibly 100% of the work you do from January until May goes towards taxes

- Bank: Your biggest expenses are your mortgage and credit card debt

“Wealth is a person’s ability to survive so many number of days forward– or, if I stopped working today, how long could I survive?”

For example, if a person has $1,000 a month in cash flow from their asset column and they have monthly expenses of $2,000 a month, they will only be wealthy once they have $2,000 a month of cash flow to their asset column.

The average American only has less than $400 in savings, with an astounding 34% with none at all.

So to sum up:

- “The rich buy assets.

- The poor only have expenses.

- The middle class buy liabilities they think are assets.”

Chapter Three: Lesson 3: Mind Your Own Business

“The rich focus on their asset columns while everyone else focuses on their income statements.”

While most people assume that Ray Kroc, the founder of McDonald’s, is in the hamburger business, Kroc once told an MBA class that he’s actually in the real estate business. That’s why he carefully chose every location for his franchises. Today, McDonald’s owns more real estate than any other organization in the world – even the Catholic church.

When someone asks the average person, “What is your business?” they typically respond with their profession. However, they are not owners of the company they work for. They still need their own business. Otherwise, they’ll spend their life working for everyone but themselves. That’s the importance of minding your own business.

Financial hardship comes from spending your life putting money into someone else’s pocket instead of your own. But by working for others, they’ll be dependent on pay raises, getting second jobs, or working overtime.

Without a financial foundation, you’ll be stuck to your job and its security for the rest of your life.

However, it’s important to note that entrepreneurship can be a tricky path. In one instance, Robert Kiyosaki tried to get a loan. The loan committee saw that he owned a lot of real estate properties. However, they struggled to understand why he didn’t have a salary or a 9 to 5 job. Even though, at the time, he did own many assets such as Armani suits, art, golf clubs, and of course, property.

It’s also good to note that as you sell your assets, the government taxes you on the gains. Robert recommends to “keep your expenses low, reduce liabilities, and diligently build a base of solid assets.” If you have children, advise them to build assets before they move out or fall into the trap of the rat race.

Here are a few more assets that Robert recommends that you or your children acquire:

- “Businesses that do not require my presence. I own them, but they are not managed or run by other people. If I have to work there, it’s not a business. It becomes my job.

- Stocks

- Bonds

- Income-generating real estate

- Notes (IOUs)

- Royalties from intellectual property such as music, scripts, and patents

- Anything else that has value, produces income, or appreciates, and has a ready market”

Rich dad used to say, “If you don’t love it, you won’t take care of it.”

You can keep your day job, but you should also start buying assets like those listed above.

Since 90% of companies fail, Robert Kiyosaki’s goal is to sell the entire stock of a company within a year of going public.

To become rich, you’ll need to buy luxuries last. People who buy luxuries first are often in much debt. The aim is to build income-generating assets that can buy luxuries.

Chapter Four: Lesson 4: The History of Taxes And The Power of Corporations

“My rich dad just played the game smart, and he did it through corporations– the biggest secret of the rich.”

The poor often say, “‘Why don’t the rich pay for it?’ or ‘The rich should pay more in taxes and give it to the poor.’” However, the real rich never pay taxes. The people who pay taxes are the educated, middle class.

While poor dad knew the history of education, rich dad knew the history of taxes. Taxes originated in England and America temporarily to pay for wars. It wasn’t until 1874 when England permanently added income taxes as a requirement of its citizens. It started in 1913 for Americans. An interesting tidbit about taxes is that it was initially only for the rich to pay. That’s what governments told the poor and middle class to help get them on board with the idea. That was how it got voted into law in the first place.

Poor dad: paid to spend money and hire people; government gains respect the bigger it gets

Rich dad: gains respect of investor by spending and hiring less

Poor dad: the rich are ‘greedy crooks’

Rich dad: the government are ‘lazy thieves’

The rich don’t get taxed as tax laws help them to create jobs and provide housing. Thus, the government is dependent on the middle class for their tax revenue.

The rich put their money into a corporation. Their asset puts income into their corporation, and then corporate income can be used as income for their personal income statement. And the expenses from their personal income statement can go into the expenses for the corporation. Even though the masses continuously try to find ways to tax the rich, the rich consistently outsmart them.

Something to remember about the government is that if they don’t spend their allotted funds, they’ll risk losing money when the next budget is announced. They aren’t rewarded for being efficient spenders. Yet, entrepreneurs are rewarded for financial efficiency. The mindsets between the two are polar opposite.

The rich look for legal loopholes to avoid paying taxes. That’s why they often hire the smartest accountants and attorneys.

In real estate, Robert Kiyosaki uses one of these legal loopholes as well. There’s a section called 1031 in the Internal Revenue Code that allows a seller to delay the payment of taxes in w when they sell real estate provided that they buy a more expensive piece of real estate. Thus, by consistently trading up, he delays getting taxed until the time comes to liquidate. This strategy also allows him to continue building his asset column.

Knowing the law can help save you money (while also making sure you follow it).

Poor dad: climb the corporate ladder

Rich dad: own the corporate ladder

When Robert was in his mid-twenties working for Xerox, he realized how disappointing it was to look at his paycheck. His bosses would talk to him about promotions and pay raises. However, that only made him see his deductions rise too. He could see himself becoming his poor dad. This realization is what made him realize he needed to follow his rich dad’s path. So Robert turned to minding his business by building out his asset column so he could invest in Hawaii’s real estate market. This newfound motivation made him work harder at selling Xerox machines at work. He knew he was building something bigger than himself.

After three years of hard work, his real estate business was making more than he was at Xerox. His company bought him his first Porsche. His coworkers had no idea that he wasn’t spending his commissions on the Porsche but assets.

Financial IQ is made up of four key areas:

- Accounting: ability to read numbers

- Investing: the concept of money making money

- Understanding markets: knowing supply and demand

- The law: knowing the tax advantages and protections your corporation can provide

- Tax advantages: corporations can pay expenses before taxes, which employees can’t do. A corporation can spend everything it can and be taxed only on everything left over. You can expense car payments, insurance, repairs, health club memberships, and most restaurant meals.

- Protection from lawsuits: The rich use corporations to protect their assets from creditors, whereas the poor and middle class try to own everything themselves.

Business Owners with Corporations

- Earn

- Spend

- Pay Taxes

Employees Who Work for Corporations

- Earn

- Pay Taxes

- Spend

Chapter Five: Lesson 5: The Rich Invent Money

“Often in the real world, it’s not the smart who get ahead, but the bold.”

When companies downsize, employees often blame the owners for being unfair. In a news story he saw, Robert Kiyosaki shares, “A terminated manager of about 45 years of age had his wife and two babies at the plant and was begging the guards to let him talk to the owners to ask if they would reconsider his termination. He had just bought a house and was afraid of losing it.” Inside of us is both someone brave and someone who will get on their knees and beg.

However, when we’re so afraid that we start doubting ourselves, we fail to push forward. Instead, it’s the bold who get ahead.

Aim to convert your fear into power.

The result of gaining financial literacy and taking risks is “having more options.”

In the future, we’ll be seeing a rise in successful companies being created but also a surge in companies failing– downsizing and laying off employees. It’s better to be making millions from the assets you build than aiming to get a raise. This period is a great era to be building assets.

Wealth over the years

- 300 years ago: the person who owns land

- Later: the person who owns factories and production

- Today: the person with the most timely information

“The players who get out of the Rat Race the quickest are the people who understand numbers and have creative financial minds.”

It is possible to have the money yet still struggle to move ahead financially.

Some people have a great opportunity present itself only to fail to have enough money to take advantage of it. Others have a fantastic opportunity present itself only to lack the ability to recognize that it’s a great opportunity (and they may even have the money to take advantage).

The strategy of the average person is: “Work hard, save, and borrow.” But instead of working hard, they should aim to improve their financial intelligence so that they can make more money. The people who get rich the fastest are those who realize that money isn’t real.

“The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.”

Today, savers are considered losers. The reason for this is because interest rates have never been lower. Plus, banks now charge you for holding your money.

During the stock market crash, Robert Kiyosaki was short of cash as he had his money in the stock market and apartment houses. However, he knew this was the time to buy. He and his wife had about a million dollars to invest in some amazing deals. He decided to shop for houses at the bankruptcy attorney’s office. He asked a friend for a $2,000 loan with a return of $200, so he could buy a $20,000 home that was worth about $75,000. He then ran an ad promoting the house for $60,000. It sold within minutes. He asked for a $2,500 processing fee. Thus, giving his friend his money back without using any of his own money. Thus, earning him a profit of $40,000 with a promissory note. The whole process took him five hours.

At the time Rich Dad Poor Dad was published, there had been three stock market crashes in 30 years.

- 1989-1990: real estate

- 2001-2002: dot-com bubble burst

- 2008-2009: housing bubble burst

All of these stock market crashes were investment opportunities.

Which one sounds harder?

- “Work hard. Pay 50% in taxes. Save what is left. Your savings earn 5%, which is also taxed. OR

- Take the time to develop your financial intelligence. Harness the power of your brain and asset column.”

Most of Robert Kiyosaki’s financial growth comes from real estate and small-cap stocks.

“The problem with ‘secure’ investments is that they are often sanitized, that is, made so safe that the gains are less.”

In one example, Robert Kiyosaki paid $45,000 on the house worth $65,000 that the owner was struggling to sell. The first year he rented it out to a local professor. And after expenses, he nets $40 a month. However, a year later, when the market picked back up, he sold it for $95,000. Since he had used the money to buy a bigger property, a 12-unit apartment, he was able to defer the payment of capital gains. He spent $300,000 on the apartment. And only two short years later sold it for $495,000 and bought a 30-unit apartment building with a cash flow of $5,000 a month. A few years later, he sold it for $1.2 million.

The best deals aren’t usually offered to newcomers. They’re often reserved for the rich. But the more sophisticated you get at the game, the more opportunities you’ll be presented with. Most of Robert Kiyosaki’s millions started with as little as $5,000 or $10,000 investments.

In the past, Robert has bought 100,000 shares at 25 cents a share before a company goes public. Then, the company goes public, and whether it’s $2 each or if it flies to $20, you can sometimes make a million dollars in less than a year.

“It’s not gambling if you know what you’re doing. It’s gambling if you’re just throwing money into a deal and praying.”

Robert Kiyosaki shares, “Most people never win because they’re more afraid of losing. That is why I found school so silly. In school, we learn that mistakes are bad, and we are punished for making them. Yet if you look at the way humans are designed to learn, we learn by making mistakes. We learn to walk by falling down. If we never fell down, we would never walk.”

People’s fear of losing causes them to not be rich. “People who avoid failure also avoid success.”

Three skills of an investor:

- Find an opportunity that everyone else missed: see with your mind instead of your eyes

- Raise money: know how to raise capital outside of a bank

- Organize smart people: hire people more intelligent than you

Chapter Six: Lesson 6: Work to Learn – Don’t Work For Money

“Job security meant everything to my educated dad. Learning meant everything to my rich dad.”

During an interview with a journalist, Robert Kiyosaki learned that the journalist strived to become a best-selling author. He realized she was a great writer and that she should pursue that. She told him that she had tried, but no one was interested. He accidentally offended her when he told her to take a sales course so she could promote herself. She became defensive.

She replied, “I have a master’s degree in English literature. Why would I go to school to learn to be a salesperson? I am a professional. I went to school to be trained in a profession, so I would not have to be a salesperson. I hate salespeople. All they want is money.” She packed her things. Robert Kiyosaki gently pointed out that he was the best-selling author, not the best-writing author. This statement only infuriated her more, and the interview ended.

The world has many successful and talented people: doctors, lawyers, dentists. And still, they struggle financially. But as a wise business consultant once said, “They are one skill away from great wealth.” If you took your skillset and paired it with financial intelligence, accounting, investing, marketing, or law, you could achieve great wealth.

If that journalist had instead picked up a job at an ad agency to learn how to sell, she could go on to create great wealth with her writing.

Rich dad says, “You want to know a little bit about a lot.” In school and at work, you’re expected to specialize. Those who earn promotions tend to be specialists. However, Robert Kiyosaki’s rich dad always recommended the opposite. That’s why, throughout the years, Robert would work in different areas of his rich dad’s company. He was expected to attend meetings with lawyers, bankers, accountants. It was essential to the rich dad for Robert to know every aspect of creating an empire.

When Robert Kiyosaki had quit his high-paying job, his poor dad had a heart to heart talk with him, failing to understand his mindset for quitting.

Poor dad: values job security

Rich dad: values learning

Poor dad: assumed Robert went to school to learn how to be a ship’s officer

Rich dad: knew Robert went there to study international trade

The reason Robert had quit his job was so that he could learn how to lead people as his rich dad said, “If you’re not a good leader, you’ll get shot in the back, just like they do in business.”

“Job is an acronym for ‘Just Over Broke.’”

Robert Kiyosaki recommends taking on jobs where you can learn new skills instead of jobs that pay the most.

The biggest fear for aging Americans is running out of money before they die. When you add up health costs and long-term nursing home care, it’s quite likely that the average American will run out of money during their retirement.

“Are workers looking into the future or just until their next paycheck, never questioning where they are headed?”

The best advice Robert Kiyosaki has for those looking to earn more money is to pick up a second job that’ll teach them a second skill.

It’s normal to feel a bit of resistance to that idea; you might not be excited to do something you aren’t passionate about. But remember, you go to the gym not because you want to but because you want to be healthy and live a long life.

Robert shares the story of an artist in Hawaii who inherited $35,000. He used the money to run ads in an expensive magazine that targeted the rich. However, not a single person reached out. He lost his entire savings. The artist is now trying to sue the magazine for misrepresentation. However, the reality is that he didn’t have any advertising experience. When Robert asked this artist if he’d be interested in taking a course, he said, “I don’t have the time, and I don’t want to waste my money.” Most people focus on improving their product rather than learning how to sell it.

Management Skills Needed for Success:

- Management of cash flow

- Management of systems

- Management of people

“The most important specialized skills are sales and marketing.”

Robert Kiyosaki’s friend Blair Singer shares, “Sales = Income. Your ability to sell– to communicate and position your strengths– directly impacts your success.”

Most people fear rejection, which is why they’re often intimidated by sales and marketing.

Law of Money: “Give, and you shall receive.”

Robert shares, “In conclusion, I became both dads. One part of me is a hard-core capitalist who loves the game of making money. The other part is a socially responsible teacher who is deeply concerned with this ever-widening gap between the haves and the have-nots. I personally hold the archaic education system primarily responsible for this growing gap.”

Chapter Seven: Overcoming Obstacles

“The primary difference between a rich person and a poor person is how they manage fear.”

There are five core reasons why even the financially literate don’t become financially independent:

- Fear

- Cynicism

- Laziness

- Bad habits

- Arrogance

Not even the rich, like losing money. No one does really. Rich dad says, “Some people are terrified of snakes. Some people are terrified of losing money. Both are phobias.” That’s why it was so crucial for Robert’s rich dad to teach his two sons how to take risks at a young age. The younger you are, the easier it is to become rich.

Approach risk like a Texan. Texans both win big and lose big. Their attitude is what’s game-changing. They feel a sense of pride when they win, but they still brag even if they lose. They lack a fear of loss. Their loss inspires them.

Before you win, you lose. Like all those times you fell off a bicycle before you learned how to ride it. Before people became rich, they lost money. Most people are more afraid of the pain of losing money than the happiness of becoming rich.

“Rich dad knew that failure would only make him stronger and smarter.”

Losers are defeated by loss. Winners are inspired by loss. You can still hate losing without being afraid of it.

Most people invest in low-yield mutual funds because it’s the safe thing to do. But that’s not the portfolio of a winner.

To be successful, you’ll need to be focused, instead of balanced.

FOCUS: Follow One Course Until Successful

Don’t let doubt cause you not to act. Avoid remarks from friends and family, such as, “‘What makes you think you can do that?’ ‘If it’s such a good idea, how come someone else hasn’t done it?’ ‘That will never work. You don’t know what you’re talking about.’”

Investors know that when it’s a period of doom and gloom, that’s the best time to make money.

Robert’s friend Richard recently asked him for advice on buying property. The two of them identified a two-bedroom townhouse for only $42,000. Others at the time were selling for $65,000. He bought it. But after talking to a neighbor, he backed out, thinking he got a bad deal. A short few years later, the property was worth $95,000. And Richard’s small investment of $5,000 could’ve helped him get out of the Rat Race. Doubt can be a deal killer.

When it comes to financial education, you need to know the difference between good debt and bad debt. Analyze instead of criticizing.

Most people say they’re too busy to focus on their wealth and health, but really they’re avoiding it.

“Rich dad believed the words ‘I can’t afford it’ shut down your brain. ‘How can I afford it?’ opens up possibilities, excitement, and dreams.” Instead of buying his kids everything they wanted, rich dad asked them to think about how they can afford it. Rich dad never gave Robert or Mike anything. The boys had to pay for college on their own.

The financial struggle often comes from bad habits. You need to pay yourself first. Otherwise, you likely won’t be left with anything after paying your bills. That’s because if you pay yourself first and fail to have enough money left over for bills, you’ll need to find new ways to earn more money. It becomes a motivator – especially when debt collectors start calling.

“What I know makes me money. What I don’t know loses me money.”

Chapter Eight: Getting Started

A gold miner in Peru once told Robert Kiyosaki, “There is gold everywhere. Most people are not trained to see it.”

Robert said this was also true for him in real estate. He said he could find about four to five excellent properties a day, whereas others may look and find none.

10 Steps to Develop Your God-given Powers

- Find a reason greater than reality: the power of spirit

- A young woman who dreamed of going to the Olympics would swim every morning for three hours before going to school. She also spent her weekends studying to maintain high grades. When asked why, she responded, “I do it for myself and the people I love. It’s love that gets me over the hurdles and sacrifices.”

- Make daily choices: the power of choice

- With every dollar we receive, we choose whether we become: rich, poor, or the middle class. However, you need to train your children to know how to manage your assets. Otherwise, they’ll be lost in the next generation.

- It’s important to learn how to invest before investing.

- Choose friends carefully: the power of association

- You don’t have to choose friends based on their financial statements.

- Choose friends who talk about money and are interested in the subject.

- People with money often report that their friends without money never ask them how they did it. But they do ask for: a loan or a job.

- Master a formula and then learn a new one: the power of learning quickly

- Study what you want to do. For example, if you want to be a cook, study cooking.

- If you want to make money, don’t work for it.

- Most people learn but fail the most crucial step: action.

- It’s not what you know but how fast you learn.

- Pay yourself first: the power of self-discipline

- Without self-discipline, you wouldn’t know how to manage a million dollars if you were to receive it.

- You’ll only get pushed around in life if you lack self-discipline and internal control.

- Three most important management skills to start your own business:

- Cash flow

- People

- Personal time

- People who pay themselves first end up using the money to acquire assets that pay for their expenses, and then they’re leftover is income. People who pay themselves last, lose all their money with expenses.

- Even if your cash flow is far less than your bills, you need to pay yourself first.

- Robert Kiyosaki has more liabilities than most of the population, but he uses tenants to pay for his debts.

- Tips for paying yourself first:

- “Don’t get into large debt positions that you have to pay for. Keep your expenses low.”

- Don’t dip into your savings when pressure builds. Use the pressure to find new ways of making more money.

- Savings need to be used to make more money instead of paying bills.

- Pay your brokers well: the power of good advice

- Pay professionals well and have expensive attorneys, accountants, real estate brokers, and stockbrokers. Their services should be making you money. Those professionals who make more will also make you more money.

- Poor people will often tip restaurant servers 15-20 percent even with lousy service but get mad when they need to pay a broker three to seven percent.

- Have a board of directors; it’s essential to have people working for you who are smarter than you.

- Be an Indian giver: the power of getting something for nothing

- “The sophisticated investor’s first question is: ‘How fast do I get my money back?’ They also want to know what they get for free, also called a ‘piece of the action.’ That is why the ROI, or return on investment, is so important.’

- When Robert Kiyosaki wanted to buy a small condominium in foreclosure, he submitted a bid $10,000 less than asking. But since he presented a cashier’s check with the full amount, the bank knew it was a serious deal and accepted it. After three years of renting out the property, Robert Kiyosaki officially owns the asset, which continues to make him money.

- When you acquire an investment, you should aim to get something free with it– for example, a condominium, a piece of land, stock shares, etc.

- McDonald’s founder, Ray Kroc, wanted the land underneath every McDonald’s location for free with every franchise he opened

- Use assets to buy luxuries: the power of focus

- A father wanted to teach his child how to make money. His son had been asking for a car but didn’t want him spending his college money on it. His father gave him $3,000 that the son could use to buy a vehicle indirectly. So he couldn’t use the cash to buy a car. His son started learning how to invest in stocks. He read every book, he read publications, and even though he lost $2,000 in the stock market, his interest had been piqued.

- Don’t buy luxuries with liabilities like credit, buy them from your asset column

- If 100 people got $10,000 at the beginning of the year, by the end:

- 80 would have spent it all or gone further in debt

- 16 would’ve increased the amount by 5-10 percent

- Four would have either doubled it or grew it to the millions

- Choose heroes: the power of myth

- Robert Kiyosaki’s heroes are Warren Buffett, Peter Lynch, George Soros, etc.

- When Robert Kiyosaki analyzes a deal, he tries to look at it the same way Warren Buffett would. This strategy helps him tap into raw genius.

- Teach and you shall receive: the power of giving

- Robert’s rich dad taught him to be charitable. His poor dad taught him to give away his time and knowledge, but not money.

- Rich dad says, “If you want something, you first need to give.”

- If you want money, give money.

Chapter Nine: Still Want More? Here Are Some To Do’s

Stop doing what you’re doing.

- If it’s not working, try something new.

Look for new ideas.

- Read how-to books with formulas on topics you want to learn more about.

- Read: The 16 Percent Solution by Joel Moskowitz

Find someone who has done what you want to do.

- Find the expert who has done something you want to do and pick their brain so you can learn from them.

Take classes, read, and attend seminars.

- Many classes are free or low cost, search the internet for them so you can absorb more knowledge.

Make lots of offers.

- Robert submits offers on multiple real estate properties that he wants. He leaves the deal up to the real estate agent, who is the expert, whereas he isn’t.

- Most sellers ask for too much money, and until there’s a second offer, it’s hard to know what the right price is.

- You’d be surprised at how many people would say yes to an offer.

Jog, walk, or drive a certain area once a month for ten minutes.

- You’ll find some of the best real estate investments by driving around. He might talk to postal workers, moving truck workers, retailers, and so forth to better understand a neighborhood.

Shop for bargains in all markets.

- “Profits are made in the buying, not in the selling.”

Look in the right places.

- Most people buy with real estate agents. Robert Kiyosaki buys at the foreclosure auction.

Look for people who want to buy first. Then look for someone who wants to sell.

- When buying property, find a seller first then find a person who’s looking to sell their property and buy through them.

Think big.

- If your business is buying something in bulk, call some friends up to see if they’re looking for that as well. Then, you can negotiate deals for having a large bulk purchase, so you get the best deal on what you’re buying.

Learn from history.

- “All the big companies on the stock exchange started out as small companies.”

Action always beats inaction.

- Act now!

Final Thoughts

Robert’s friend was once trying to save up for his four children’s college educations. But with only $12,000. It was clear it wasn’t going to happen any time soon. He advised his friend to buy a property in Phoenix since there was a slump in the market. After two weeks, they found a three-bedroom, two bathroom home in a good area. The homeowner was desperate to sell. They ended up buying the property for $79,000, even though the owner wanted $102,000. His friend needed a down payment of $7,900. Each month after all expenses were paid, his friend pocketed $125. He planned to keep the house for 12 years. He used his $125 to pay down the mortgage even faster. Three years later, someone offered him $156,000 for the house. Robert advised him to sell it using a 1031 tax-deferred exchange. Next, he bought a mini-storage facility. After three months, he was making $1,000 a month that he put into the college fund. A couple of years later, he sold that mini-warehouse for close to $330,000. His next investment made him $3,000 a month in income, going back to the college fund. The man now feels confident in his ability to pay for his children’s college education. And it all started with only $7,900.

There are three types of income

- Ordinary earned

- Portfolio

- Passive

Poor dad: ordinary earned, get a safe and secure job

Rich dad: portfolio and passive, make money work for you

“The key to financial freedom and great wealth is a person’s ability to convert earned income into passive and/or portfolio income.”

Warren Buffett advises that “Risk comes from not knowing what you’re doing.”

Rich dad would often say, “If you want to be rich, you must know what kind of income to work hard for, how to keep it, and how to protect it from loss. That is the key to great wealth… If you do not understand the differences in those three incomes and do not learn the skills on how to acquire and protect those incomes, you will probably spend your life earning less than you could and working harder than you should.”

Your destiny relies on how you spend your money and your time. Your family’s future will be determined by your choices today.

You can buy Rich Dad Poor Dad by Robert Kiyosaki on Amazon.