Even for those who aren’t considering dramatic life changes, personal finances are a big friggin’ deal. According to a survey by Northwestern Mutual, 44% of participants said that money was their biggest form of stress.

This is especially true for those who face obstacles like rising healthcare costs and massive student loan debts. It’s no wonder that money is one of the main reasons that people feel ‘held back’ from crossing items off their bucket list.

But this doesn’t have to stop you.

This blog post will cover a few travel budget tips every digital nomad should know. We’re going to walk through the steps and considerations for the transition to digital nomadism, as well as cover some strategies for how to travel on a budget.

In this article, you’ll learn how to:

- Map out your current cash flow

- Calculate your projected travel and living expenses

- Create your travel budget based on our travel budget template

- Shift into savings mode and become more nomad budget-friendly

Here we go.

Post Contents

Don’t wait for someone else to do it. Hire yourself and start calling the shots.

Get Started FreeMap out Your Current Cash Flow

First things first: understand your financial situation right now.

You’ll need to have a firm grip on ‘money in versus money out,’ or your income versus expenses. This can help you to make more targeted changes to achieve particular goals and contribute more money to your travel budget.

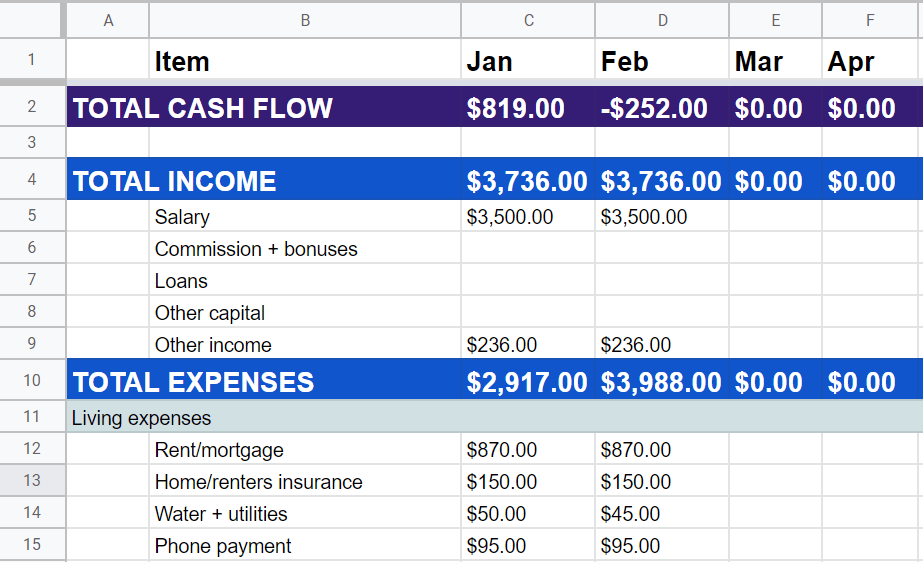

It’s a huge advantage to track this on a physical spreadsheet so you can see the hard numbers.

If you don’t already have something like this, we created a spreadsheet template that you can use.

Just pop in the monthly numbers for whatever applies to you.

As you add your values, three rows of cells will calculate your totals automatically:

- Row 2: Total cash flow – Will show if you lost or earned money in any given month. It works by subtracting your Row 10 expenses from your Row 4 income. This will display as a negative or positive sum.

- Row 4: Total income – Will calculate your total earnings for the given month

- Row 10: Total expenses – Will calculate your total spend for the given month

Note: You can access this cash flow template here. Please note that you won’t be able to fill it in directly – follow the directions for downloading your own copy to use.

Ideally, you should go through your bank and credit card statements to fill this out at least a few months back. This way, you can identify broader patterns and trends, which will help you predict how things will continue more accurately.

Then ask yourself some questions:

- Am I saving any money, or am I consistently spending more than I earn?

- Do I have an emergency fund just in case something happens on the road?

- Am I in debt? If so, how can I be more aggressive in trying to get rid of it?

- Are there any non-essential expenses that I can cut down?

We’ll dive deeper into these questions later. For now, let’s look at projected costs for your top choices so we can personalize your travel budget.

Calculate Your Projected Expenses

There’s a reason we looked at your current financial situation before getting into how to make a travel budget. If you are not great at tracking your finances, try a budget app to help you

That’s because one of the keys to being a savvy and successful digital nomad is to travel within your means. At least at the beginning of your travels, your finances should define your destinations and lifestyle.

For example, making a travel budget for the Philippines will be a lot different than one for the USA. You can easily spend at least $1,000 USD extra per month.

So your next step is to evaluate which destinations are most feasible for you. To do this, pick three to five top cities on your wishlist.

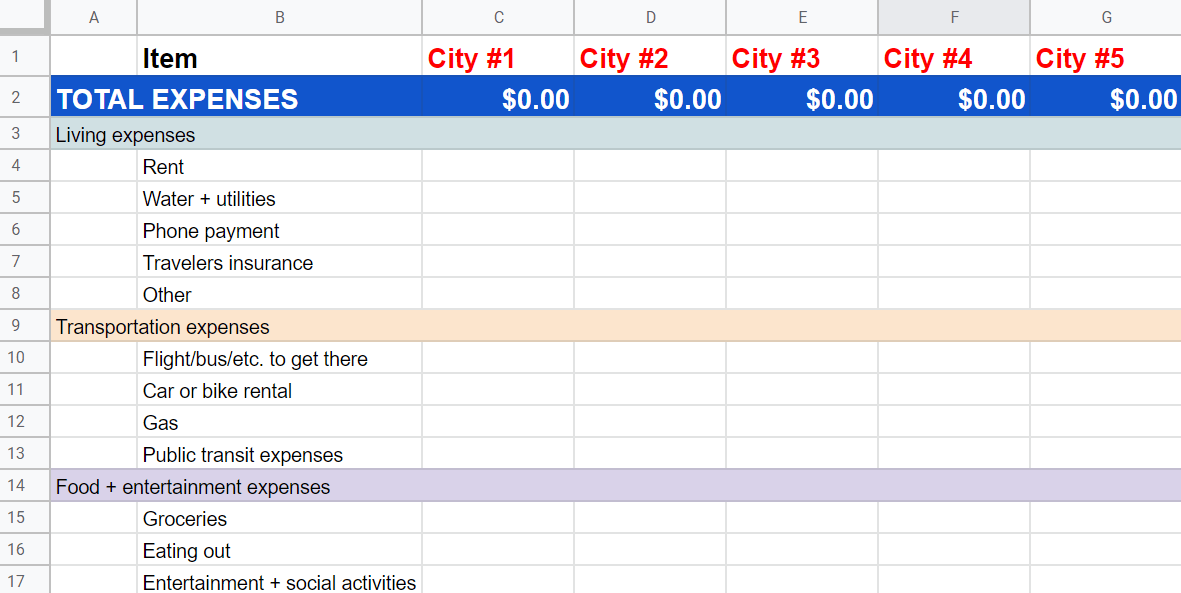

Then, fill out this travel budget template for estimated living costs for one month of staying in that city. As you can see, it’s almost identical to the personal cash flow expenses template from the previous section, with a few adjustments.

For now, you can just use rough estimates based on your research. Once you narrow down your choices, you can start documenting the planning and bookings for your actual trip.

Find your info on these travel budget estimators, some of which we mentioned in another article on digital nomad cities:

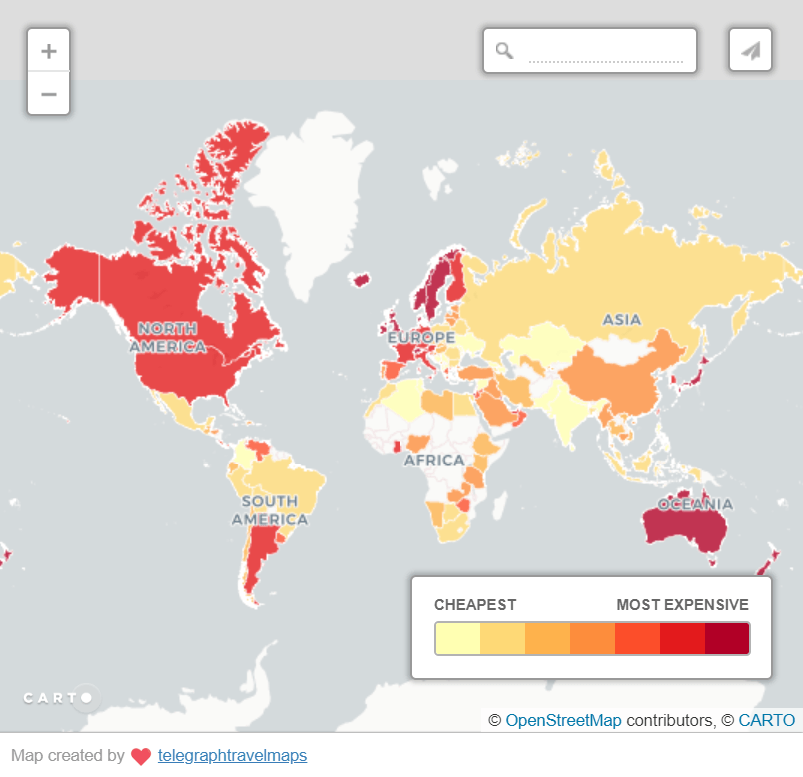

Also, check out this awesome interactive map for a quick visual of typical travel budgets by country.

Remember: Don’t take any single website or resource for its word. Do a bit more research and try averaging a couple of websites to get a more well-rounded travel budget estimate.

If you need to make some big purchases to prepare for your travels, like a good laptop, be sure to include those in the ‘Misc Expenses’ section under ‘Nomad gear or tech purchases.’ Also, don’t forget to add in the cost of your flight to get there, which you can find in the ‘Transportation expenses’ section.

Note: You can access this travel budget template here. Follow the directions for downloading your own copy to use.

Looking at your travel budget template, ask yourself:

- What’s the difference between my current costs and the costs for each of these cities?

- If I need to find a new remote job, what’s the minimum income I need to make to afford this lifestyle and still have some savings?

- Do I need to make major financial adjustments to be comfortable making the switch?

- Which of these cities is the most feasible as my first destination?

- If anything were to happen with work, do I have (or can I manage saving) three to six months worth of income to live off?

Don’t Forget About Your Taxes

Digital nomads usually don’t need to worry about paying taxes in another country unless they want to stay longer than their tourist visa.

But many don’t realize their tax obligations back home.

For example, some countries like the U.K. and Australia are making it harder for their citizens to qualify for tax non-residence. Tax non-residence means that citizens of these countries don’t need to pay taxes if they live abroad.

If you’re a U.S. citizen, you have a whole other set of problems.

The U.S. is one of the only countries that taxes based on citizenship instead of residence. This means that unless you qualify for certain loopholes and exemptions, you’ll still need to file and possibly pay taxes if you’re a U.S. citizen.

And, if you’re a freelancer or otherwise self-employed, you’ll also need to pay 15.3% self-employment tax. This can blindside those who are fresh to the freelancing world and put a huge dent in your travel budget. It might be worth the extra work to incorporate into an S-corp or LLC to save on your tax bill.

The moral of the story is: no matter where you live, please do your research and hire a CPA if you think you need one. Taxes are nothing to mess with.

Shift Into Savings Mode

For many people, a basic level of financial security is important for making the jump.

As you figure out the general costs for your ideal destinations and lifestyles, and examine how to travel on a tight budget, you may be one of those people who thought to themselves, “I’m gonna need to save up for a little while.”

That’s perfectly normal. In fact, it’s recommended.

Let’s go over a few ways that you can shift into a more savings-oriented mindset. It’ll help you save some cash, and might even teach you some valuable skills around how to budget your travel costs.

Reduce or Eliminate Your Debt

Debt sucks. Anyone who has debt knows that it can feel like a dark cloud looming overhead.

If you’re struggling with debt, I feel for you. I also believe that it doesn’t need to keep you from doing big things.

Here are a few strategies and tips that might help to reduce or eliminate your debt so you can contribute more toward your travel budget.

Pay more monthly to avoid interest

The beauty – and the trap – of debt is that you can opt for minimum monthly payments. On the surface, minimum payments can help you get your head above water if you’re really struggling. But if you get too comfortable, this will add up and cost you much more in the long run.

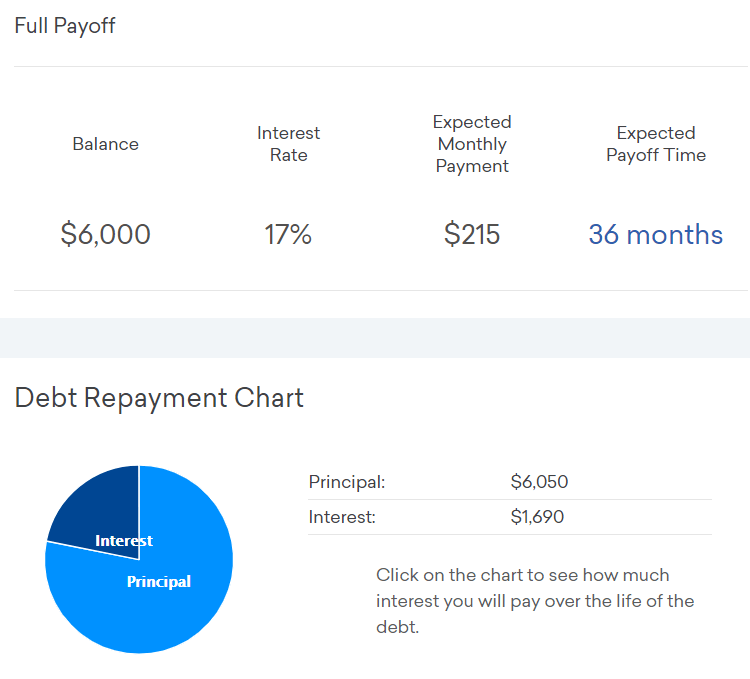

You can use a handy debt repayment calculator like this one on Credit Karma.

Consider a $6,000 credit card debt with 17% interest.

If you pay $215 per month, it’ll take you 36 months to fully pay off the debt including your interest, which will tack on an extra $1,690.

Ouch.

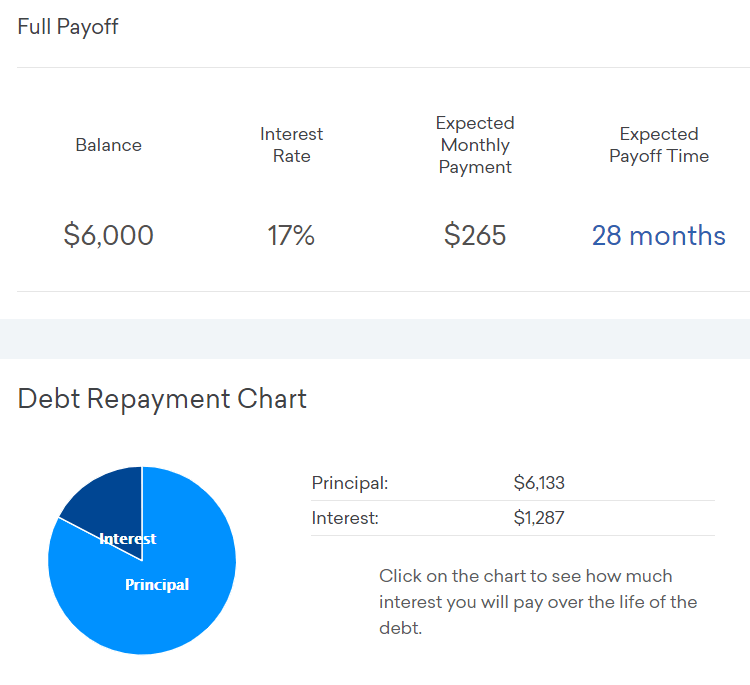

But say that you increase your monthly payment by just $50. This will cut your repayment down by eight months, and you’ll have $403 extra that you didn’t have to pay in interest.

If you have multiple debts, you might want to focus on the one with the highest interest rate first. Pay the minimum on all of your other debts, but as much as you can until your focus debt is gone. Then move to the next-highest interest rate debt, and so on until your travel budget is freed up.

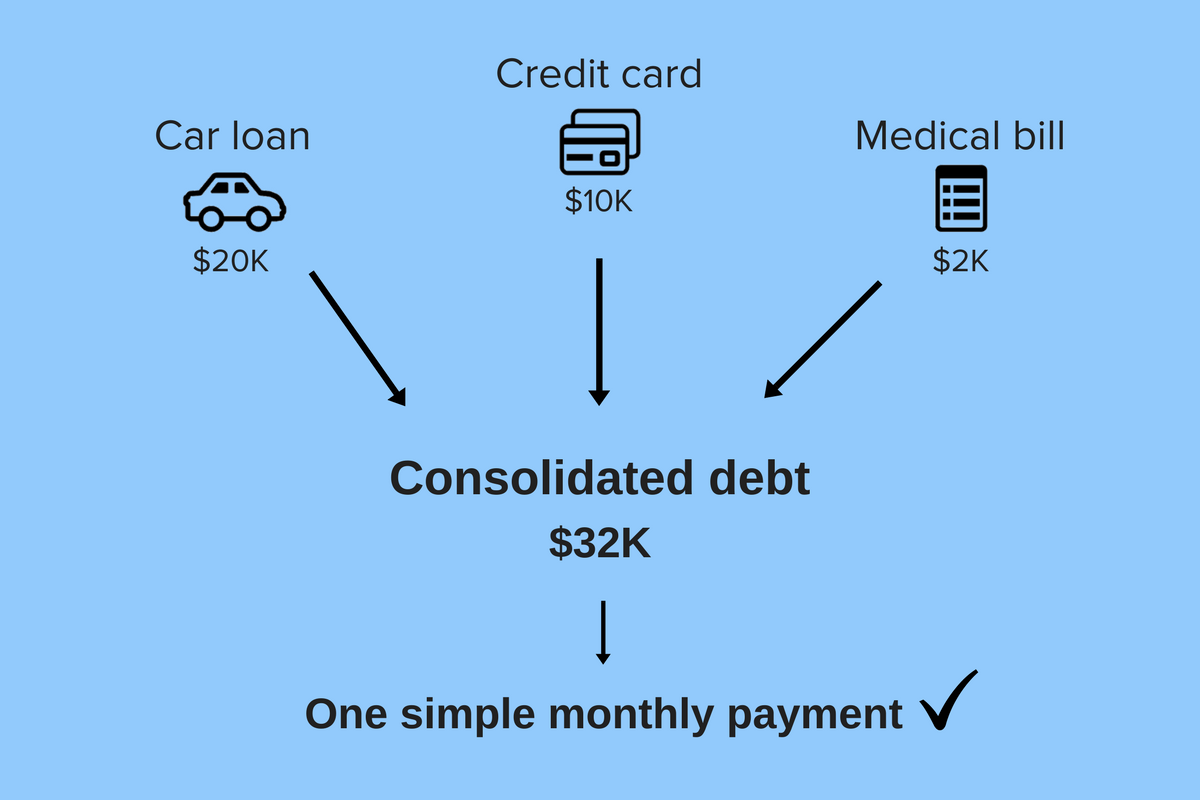

Look into debt consolidation

If you have multiple debts with high interest, debt consolidation can roll them into a single payment.

It’s then paid off in one of two ways: taking out a personal loan that often has a lower interest rate, or joining a debt management program without taking a loan.

While debt consolidation can be a good idea for some, it can also rope you into a longer agreement that might end up being higher. So if you decide to take this route, go into it with the mindset of paying it off as quickly as possible.

You might also have some luck calling your lenders and asking for a lower interest rate. This method really works for some!

Build an Emergency Fund

One essential travel budget tip is to put money into an emergency fund. If you’re struggling with debt, this can feel overwhelming on top of learning how to budget your travel.

But to put it frankly: it’s critical for you to have an emergency fund as part of your travel budget in case something goes wrong, like losing your income source or being involved in an accident.

Ideally, your emergency fund would cover six months of your living expenses. If this doesn’t feel attainable, I strongly recommend a minimum of three months.

This process can be as easy as setting aside $50 a month into an off-limits savings account.

I know a digital nomad who used a cash method to save up before she started traveling. She would randomly put aside $5, $10, and $20 bills into a physical piggy bank.

Over the course of a few months, she had saved a few hundred dollars. She then deposited it into her savings account before she hit the road.

Cut Down Unnecessary Expenses

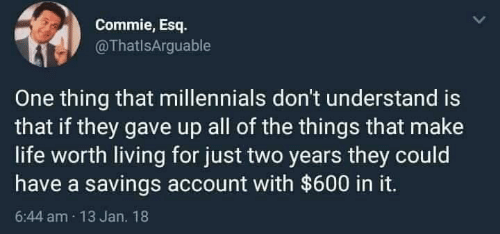

Maybe you remember the delightful story of the millionaire who told millennials to lay off the avocado toast if they want to afford a house.

Millennials had a lot to say about that.

At the end of the day, you might need to make some sacrifices to free up your travel budget and make the digital nomad lifestyle work. Just don’t beat yourself up if you want to enjoy an avocado toast every now and then, okay?

Overall, think about all your expenses that are ‘wants’ instead of ‘needs,’ and see which of those you can cut back on without sacrificing too much of your short-term happiness.

Here are some ideas to get your hamster wheel turning:

- If you have a car, carpool with friends and family more often, or occasionally walk or ride a bicycle to save on gas money

- Cook more meals at home, and cook extra so you have leftovers for lunch the next day

- Bring your own lunches from home instead of going out frequently with coworkers

- Make a physical grocery list to reduce all those delicious impulse buys

- Plan your weekly meals in advance so you’re not throwing away unused groceries

- Try opting for generic or sale items when you’re doing your shopping

- Cancel subscriptions and memberships that you can do without

- Eat a snack before you go out to dinner so that you’re satisfied with smaller plates or appetizers

- Make your own coffee every morning instead of buying from a cafe

- Unplug gadgets when you’re not using them, as they still suck electricity even when they’re off

- Make service and skill trades with your friends, like pet-sitting in exchange for a haircut

- Try to plan more friend gatherings – like a cheap picnic – instead of always going out to eat

Sometimes, all it takes is a little creativity to make some helpful upgrades to your bank account.

Take Advantage of These Travel Budget Tips

There are loads of travel budget hacks that can really add up. Let’s look at a few key tips as you get serious about planning.

Fly With Budget Airlines

Budget airlines are popping up all over the place in response to demands for cheap travel. The business model is that they won’t offer you little luxuries like free drinks and snacks, which helps them to lower their costs so they can pass the savings on to you.

Many budget airlines will also charge significantly for checking baggage – or even bringing a carry-on – so this is something to look into before you book.

Some top budget airlines for different regions include:

- USA: Frontier Airlines, Allegiant Air, Spirit Airlines, Sun Country Airlines

- Europe: RyanAir, easyJet, Wizz Air, Vueling, Volotea, Eurowings

- Asia: AirAsia, JetStar Asia Airways, IndiGo, Lion Air, Nok Air

Budget airlines aren’t known for international travel, and some regions don’t have too many of them. For example, flying in South America is generally more expensive in comparison to flying between European countries. Keep this in mind for your travel budget plan.

Look at Bus, Train, and Ferry Options

In some areas, you might have the option to choose a bus or train (or even a ferry) over a plane ride. Or in some cases, you can fly to a different airport that might be a bit farther away.

While these alternatives will typically take longer, they might save you a surprising amount.

Consider this travel budget example: say you want to get from Bangkok, Thailand, to the Thai island Koh Samui. There’s an option for a direct flight that’s only about one hour long, but costs around $100–150 USD for a one-way ticket.

Instead of the direct flight, you can take a flight to Surat Thani for $20–30 USD, then take a high-speed ferry from Surat Thani to Koh Samui for another $20.

This would add a few extra hours to your travel day, but could be well worth it depending on your travel budget.

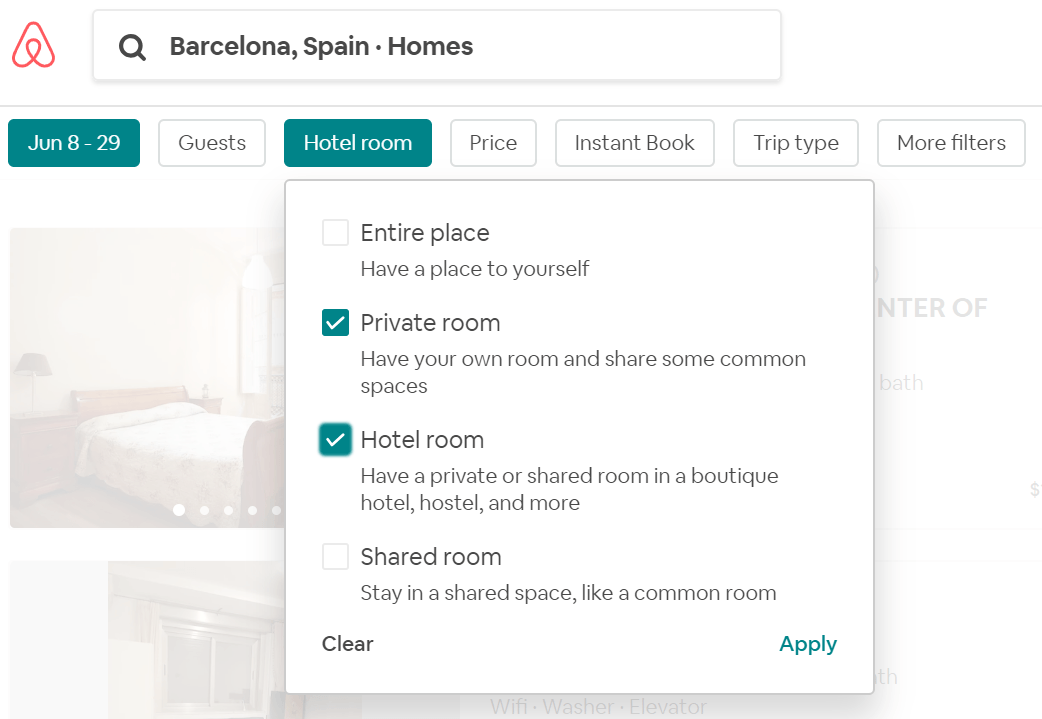

Consider Hostels or Private Room Airbnb Rentals

In general, I wouldn’t recommend staying in big dorm rooms of hostels in the long run. While they can be mega cheap – some costing less than $5 per night depending on which city you’re in – they’re also not a guarantee that you’ll get a good night’s sleep or a productive workspace.

There’s a solid chance that you’ll encounter things like loud snorers and people stumbling back at 3 a.m. after partying the night away.

Look into dorm rooms with fewer beds, or private rooms in hostels.

Check websites like:

Another consideration is that hostels don’t have the best internet reputation. Many have slow and groggy connections that can drive a nomad nuts if they don’t have a backup plan.

One possible remedy for the potential woes of hostel life is to find private rooms on Airbnb, where the host(s) rent out an extra room in their house or apartment. This allows you to maintain some privacy and peace, while still having shared access to coveted amenities like a kitchen and living room.

And since it’s a private home, they’ll usually have a decent wifi connection. You can just message hosts before you book to double-check if it’s suitable for working.

By choosing the private room option, I was able to find rooms for around $30 USD per night, as opposed to a full apartment which was more than $100 per night.

Another perk of Airbnb is that many hosts are super friendly and welcoming, often offering to take their guests out and show them around town.

I still keep in touch with several of my past hosts!

Hopefully, you have learned many new travel budget tips and now have lots of ideas about how to travel the world on a low budget.

For some, making the transition to digital nomad life will be a piece of proverbial cake. But for others, it might take a lot of discipline and sacrifice.

Regardless of the process, the end goal is waiting for you if you want it badly enough.

Keep Reading: Tapping Into the Digital Nomad Community →

Table of Contents

Chapter 1: Is a Digital Nomad Lifestyle Right for You?

Chapter 2: Work Anywhere With These Digital Nomad Jobs

Chapter 3: How to Become a Digital Nomad: 4 Tips To Prepare

Chapter 4: How to Choose Your First Destination

Chapter 5: Travel Budget Tips for the Aspiring Digital Nomad

Chapter 6: Tapping Into the Digital Nomad Community