On March 27, President Donald Trump signed the Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act.

This $2 trillion U.S. stimulus package is the largest emergency relief bill in American history. The bill plans to help people, families, businesses, and the economy cope with the disastrous effects of the COVID-19 pandemic.

So, how will it help?

Well, this U.S. stimulus package includes one-time cash payments of up to $1,200 to Americans who qualify.

In this article, we demystify everything you need to know about the 2020 U.S. stimulus package: what it is, who receives it, how much they’ll receive, and what to do to get it. We’ll also specifically hit on how small businesses can receive money.

Let’s dive in.

Post Contents

- What is the stimulus package?

- How does the U.S. stimulus package work?

- U.S. stimulus package requirements: Who gets a check?

- How much will I get?

- If I receive a stimulus check, will it affect my tax refund?

- How do I get my stimulus check?

- When will I get my stimulus check?

- I received an email, phone call, or social media message about my check – should I reply?

- What if my stimulus check is too big or too small?

- How does the U.S. stimulus package help the self-employed?

- What is the small business loan package?

- Summary: U.S. Stimulus Package 2020

- Want to Learn More?

Don’t wait for someone else to do it. Hire yourself and start calling the shots.

Get Started FreeWhat is the stimulus package?

The CARES Act is an economic stimulus package designed to help Americans affected by COVID-19. It consists of more than 800 pages detailing how it plans to stimulate the economy and help Americans cope with the changes ravaging the country.

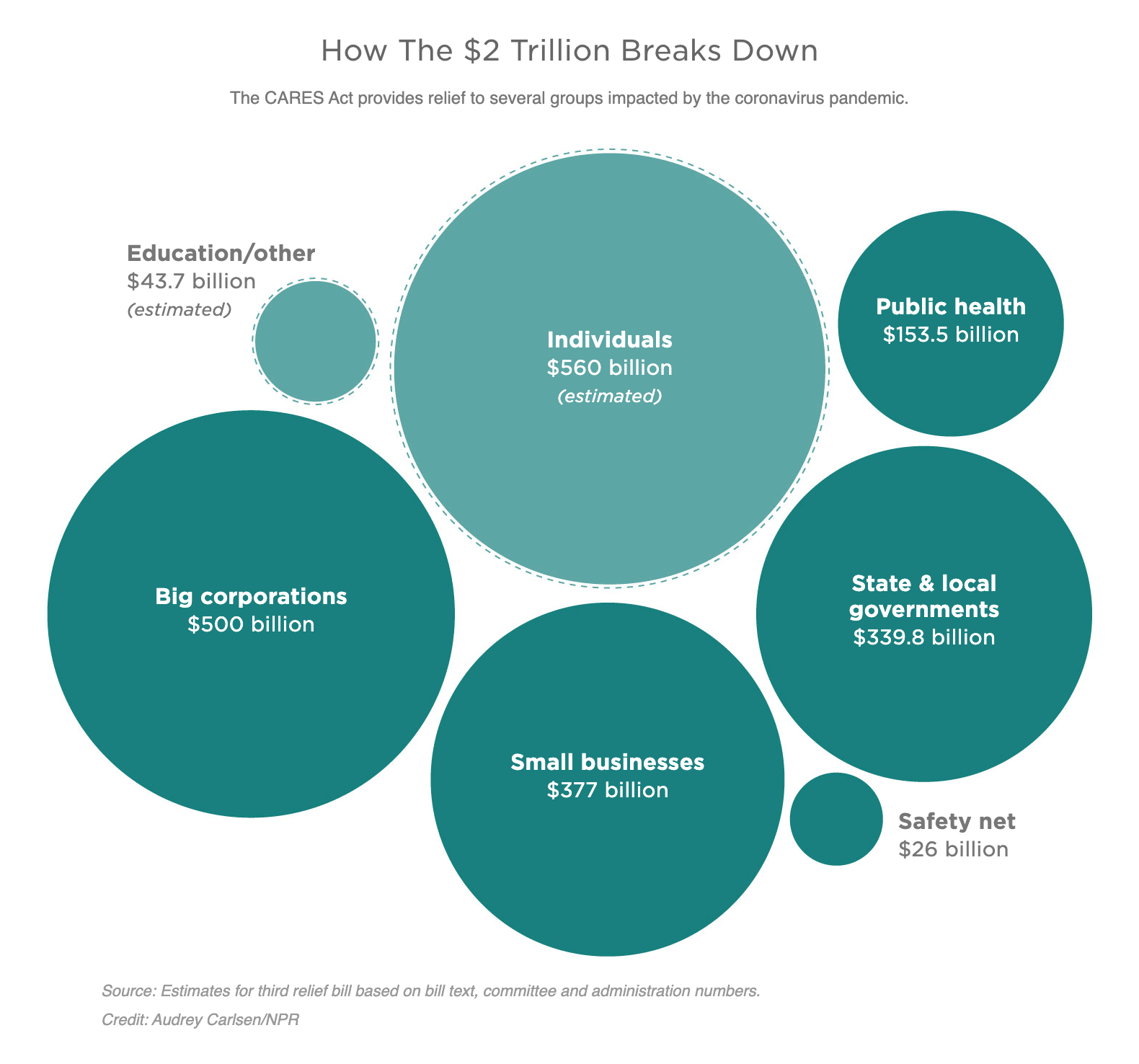

This U.S. stimulus package allocates more than $2 trillion to different groups in society, including:

- $560 billion to individuals

- $500 billion to large corporations

- $377 billion to small businesses

- $340 billion to state and local governments

- $154 billion for public health

- $44 billion for education and other causes

This handy infographic from NPR helps to illustrate the money’s distribution:

We’ll cover how small businesses and freelancers can access some of this money towards the end of the article. For now, though, probably the most talked-about aspect of the CARES Act is the one-time cash payments to individuals and families.

Technically, these are a new form of tax credit. The payment is being referred to by different names:

- The IRS has referred to it as an “economic impact payment”

- The government has called it a “recovery rebate”

- Many people are calling it a “stimulus check”

The bill also provides an extra $600 per week in unemployment benefits on top of what they’re already receiving.

People receiving unemployment benefits will also be able to draw payments for up to 39 weeks – which for many is a 13-week extension.

How does the U.S. stimulus package work?

The CARES Act is designed to help in two key ways.

- First, these stimulus checks will provide some much-needed financial assistance to those with lower incomes. The money is intended to help individuals and families to keep up with their bills and put food on the table.

- Second, putting money into the hands of people who are likely to spend it immediately is a surefire way to keep the country’s economy moving during the stagnation.

It also eases the strain on students. For those with federal student loans, the bill also defers all payments until Sept. 30, 2020. As a bonus, interest will not accrue during this period either.

The bill provides a healthcare safety net and even requires all private health insurance policies to cover COVID-19 testing, treatments, and even preventative care.

There are also loans available to help the self-employed, corporations, and small businesses survive. These loans are intended to enable businesses to continue paying their bills and the salaries of their employees, to prevent business closures and lay-offs. (We’ll talk about these more at the end of this article.)

U.S. stimulus package requirements: Who gets a check?

You will get a stimulus check if you have:

- A social security number

- Filed taxes in 2018 or 2019

- Been receiving Social Security payments because you don’t earn enough money to file taxes

- Not been claimed by someone else as a dependent

To be clear, adult dependents and nonresident aliens don’t qualify for a stimulus check.

Additionally, to receive money from this U.S. stimulus package, you have to earn less than:

- $99,000 if you file tax as an individual

- $136,500 if you file as the head of a household

- $198,000 if you file as a married couple

How much will I get?

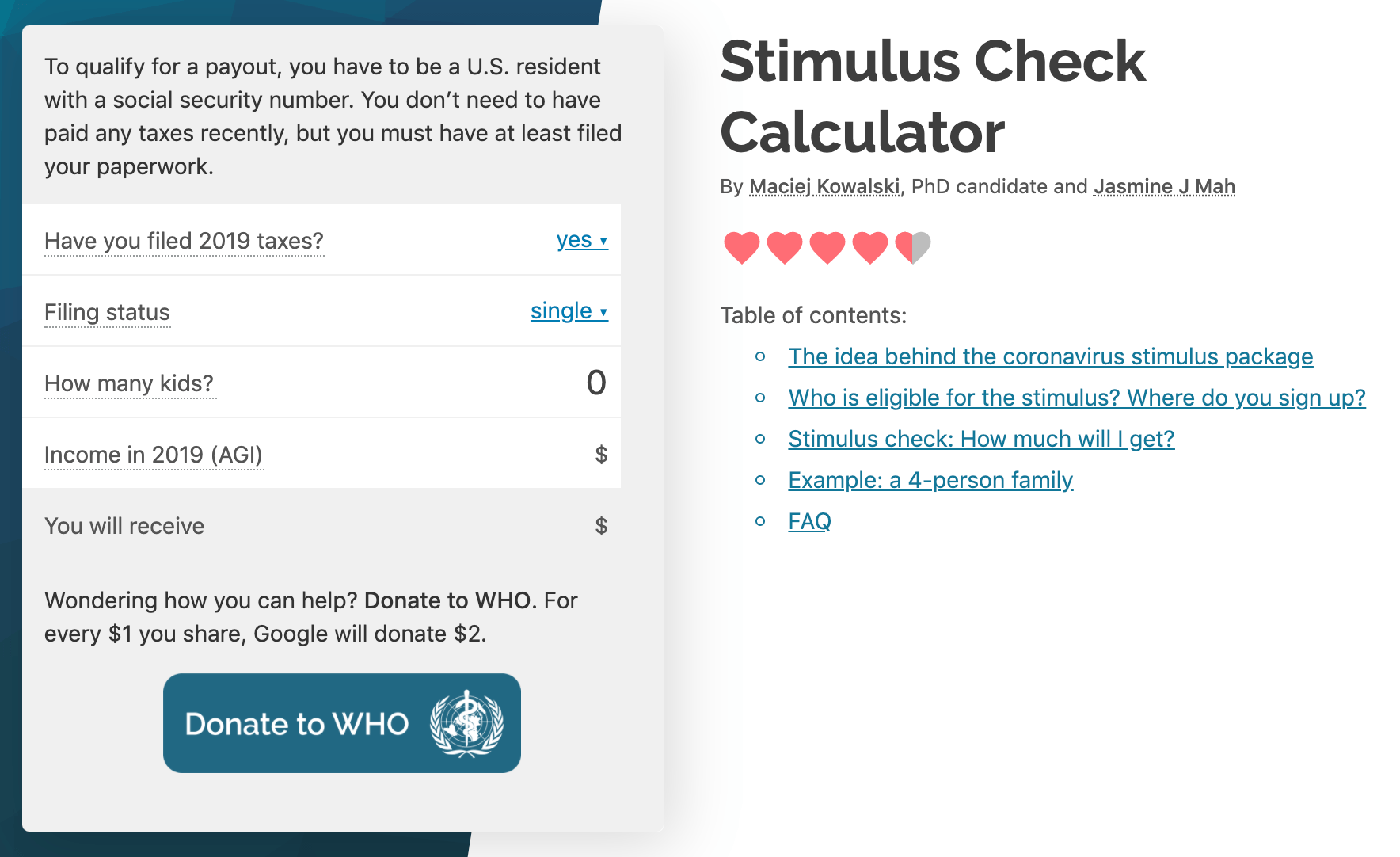

If you are eligible to receive an economic stimulus package cash payment, the amount you’ll receive is based on your adjusted gross income (AGI) on your 2018 or 2019 tax return.

Here’s a breakdown of how much you can expect to receive:

- Individuals earning less than $75,000 per year will get the full $1,200

- Couples earning less than $150,000 per year will receive $2,400

- Heads of household earning less than $112,500 per year will receive $1,200

- Families will receive $500 for every dependent child under the age of 17

Payments are reduced by $5 for each $100 over these thresholds until the limits outlined above are reached.

You can use this online calculator to work out how much you’re entitled to receive.

If I receive a stimulus check, will it affect my tax refund?

In short, no.

Even though the IRS is distributing the stimulus check through the tax system, it’s not a tax refund. This means you’ll still receive your full tax refund each year.

So, how does the stimulus check work?

Well, the stimulus checks are technically a new type of refundable tax credit. That means these payments are an advance on the this new tax credit that will appear on the tax return you file in 2021 for 2020.

In other words, the IRS isn’t giving you an advance on your standard tax refund. Instead, it’s giving you an advance on this new, special tax credit only.

And if you owe taxes right now, you’re still entitled to receive a stimulus check.

How do I get my stimulus check?

You shouldn’t have to do anything to receive your U.S. stimulus package check. The process is supposed to work automatically for most people who qualify.

However, in reality, it’s not that simple, and you may need to take steps to ensure you receive your stimulus check.

Let’s go through how it works.

If the IRS has your bank details, it should deliver the payment to you via direct deposit. Otherwise, you should be sent a paper check in the mail.

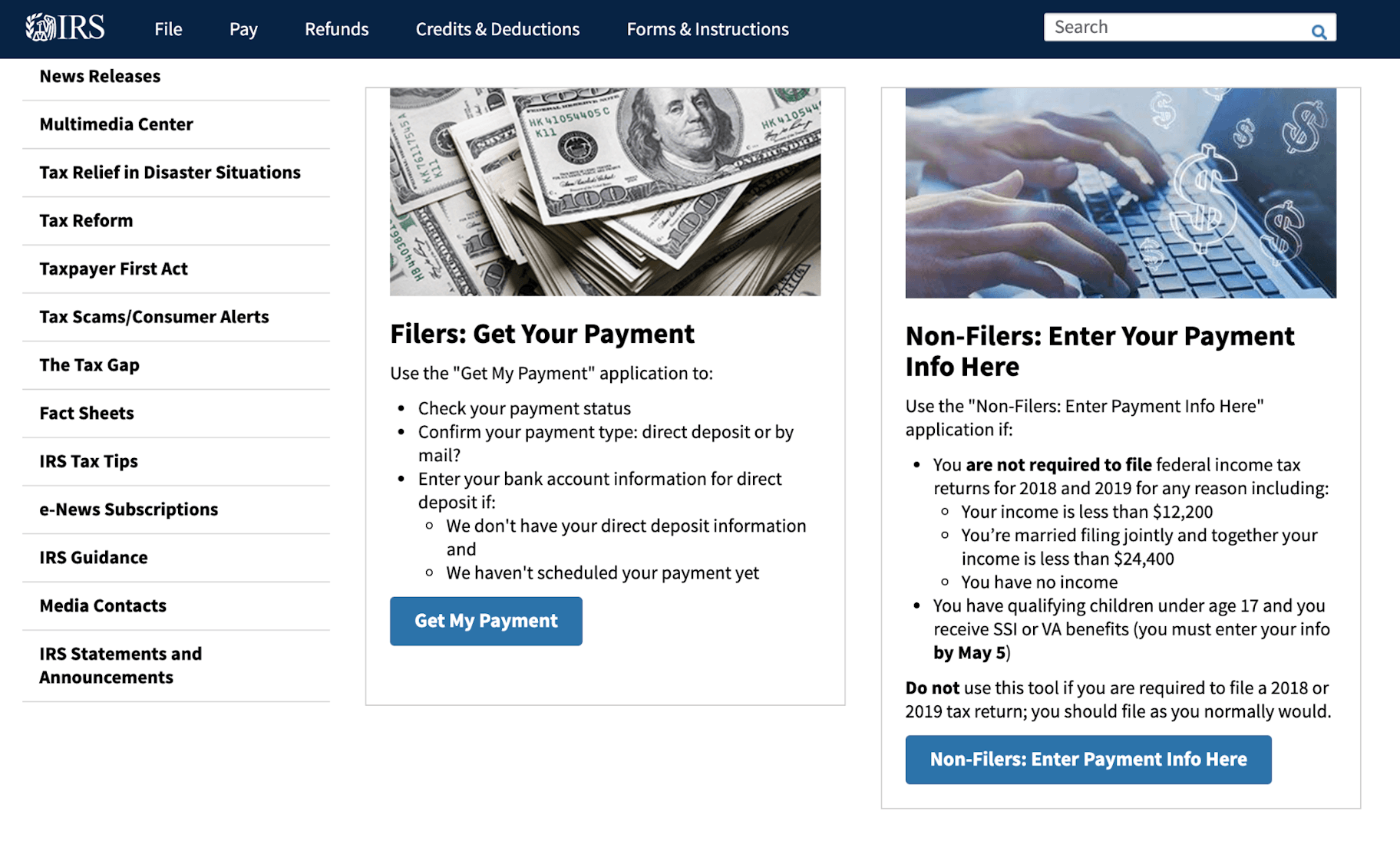

Now, if the IRS doesn’t have your bank details or your correct address on file, you will need to take steps to provide your information.

The IRS has created a tool that lets you provide your bank details or your home address to make sure you receive your direct deposit or paper check in the mail.

Now, if you didn’t file taxes in 2018 or 2019 and you don’t receive Social Security income, Supplemental Security Income (SSI), or veteran benefits, you need to use this tool on the IRS website to enter your information to receive your stimulus check.

When will I get my stimulus check?

By April 17, the IRS delivered more than 88 million stimulus payments via direct deposit, and the organization is still making payments.

However, it could take up to five months for roughly 60 million Americans to get their paper checks in the mail.

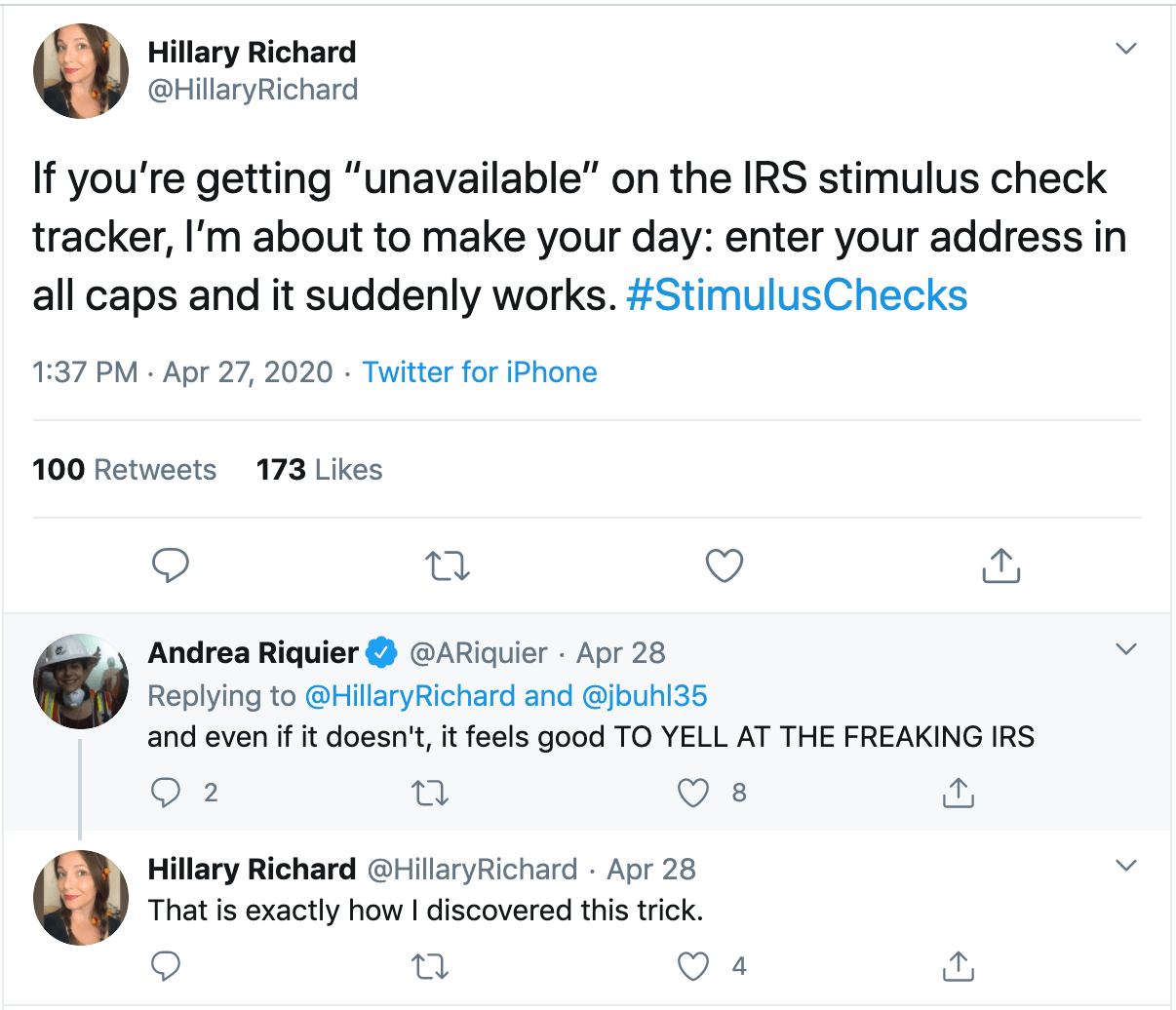

You can use this tool on the IRS website to check the status of your stimulus payment.

If the tracking tool responds “unavailable,” take some advice from New York Times reporter Hillary Richard and enter your address in all caps.

No.

The government will not call, email, message, or send you letters about the U.S. stimulus package for coronavirus.

If someone does this, it’s probably a scam.

Sadly, many scammers are using this opportunity to steal people’s money and identities. Some of the most popular scams include:

- Being sent fake checks in the mail

- Claims that you can pay an agency to receive your check sooner

- Receiving social media messages asking for personal information

- Fake agencies that ask for your social security number

The Treasury Department warns of these scams on its website:

“If you receive calls, emails, or other communications claiming to be from the Treasury Department and offering COVID-19 related grants or stimulus payments in exchange for personal financial information, or an advance fee, or charge of any kind, including the purchase of gift cards, please do not respond. These are scams. Please contact the FBI at www.ic3.gov so that the scammers can be tracked and stopped.”

What if my stimulus check is too big or too small?

If you get more money than you’re entitled to, you don’t need to do anything.

It seems that there are no provisions in the current bill that mention taking the money back. This means you shouldn’t have to repay any of the money.

Now, if you don’t receive all of the money you’re entitled to, what happens then? Tax lawyer Kelly Phillips Erb explains:

“If you should have gotten a check and didn’t, or if you should have gotten more than you did because the IRS didn’t know something important (like you have a kid), you should get more money [next tax season.]”

In other words, although it won’t help you now, you should get the rest of the money you’re entitled to when you file taxes at the end of the year.

How does the U.S. stimulus package help the self-employed?

The CARES Act covers freelancers, gig workers, and independent contracts.

Self-employed people are now eligible for unemployment benefits of $600 per week, for up to 39 weeks. These benefits are based on your previous income, using a formula from the Disaster Unemployment Assistance program.

But that’s not all.

If you’re self-employed, you’re also entitled to paid sick leave in the form of a tax credit. And you can take paid caregiving leave if your child’s school is closed or your childcare provider is unavailable because of the outbreak.

What is the small business loan package?

If you run a small business, there are several loans available.

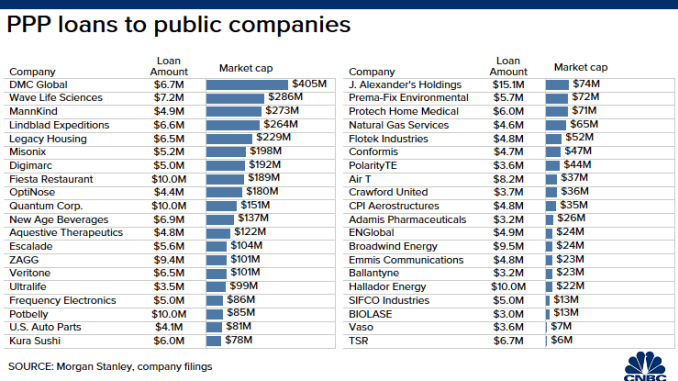

Initially, there was $377 billion set aside for small business loans in the CARES Act. However, this money ran out within two weeks.

Many were outraged that large public companies managed to secure millions in forgivable loans at the expense of actual small businesses. Those included big-name restaurant chains like Ruth’s Chris, Shake Shack, and Fiesta Restaurant – all of which secured millions of dollars in loans but have since returned the funding.

Since then, Congress approved another $370 billion to aid small businesses. The funds are divided between two programs:

The first is the Paycheck Protection Program (PPP).

This provides a loan of up to $10 million to help organizations pay their employees’ salaries.

It’s 100 percent forgivable – as long as the organization doesn’t lay off employees and it spends 75 percent of the money on payroll, then it doesn’t have to pay the money back.

The second is the Economic Injury Disaster Loan Program (EIDL).

This includes a grant of up to $10,000, which businesses don’t need to pay back. The rest of the EIDL loan of up to $2 million is not forgivable, but you can use it to pay other types of business expenses.

To be eligible for either of these programs, your business or non-profit must have 500 or fewer employees.

There’s also a loophole for restaurants, hotels, and other businesses categorized under “Accommodation or Food Services.” These businesses are eligible if they have less than 500 employees per location.

The second round of funding is likely to run out quickly, so it’s best to apply fast.

You can do this using these links:

Summary: U.S. Stimulus Package 2020

The CARES Act is the largest economic stimulus package in American history.

The bill is an attempt to stimulate the economy and help people survive the economic fallout of the COVID-19 pandemic.

If eligible, you could receive up to $1,200 to help you and your family.

If the IRS has your bank details on file, you should receive this payment any day now. However, it could take up to five months for your paper check to arrive in the mail.

Either way, you can use this tool on the IRS website to check the status of your stimulus check.

There are also two main types of loans available to help small businesses – the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan Program (EIDL).

Both of these are likely to run out of funding soon, so it’s best to apply quickly.

What are your thoughts on the U.S. stimulus package? Let us know in the comments below!