You’ve got your idea. You know how to validate it and which business model is the right match for you.

Sweet!

Now it’s time to get familiar with what’s needed to start a business logistically. Do you need to register it? If so, what are the rules for registering a business name? What are the legal requirements for your specific business type? Once you’ve started, what other considerations are critical for gaining and keeping momentum?

In some cases, the logistics of starting a business can be pretty confusing. And in some unfortunate cases, new entrepreneurs might find themselves in situations where they’re getting the run-around in terms of boxes that need to be checked off.

But don’t let these obstacles bring you down. There are lots of resources available to entrepreneurs to help get your ducks in a row. If you’re having trouble figuring things out, it might be worth spending some money on a consultant or firm that can point you in the right direction.

In this chapter, we’ll look at:

- Legal considerations, like registration and licensing, taxes, and complying with laws and regulations

- How to write a business plan to secure funding or guide your next steps

Let’s get going.

Don’t wait for someone else to do it. Hire yourself and start calling the shots.

Get Started FreeLegal issues with starting a business

The process of physically starting a company will vary greatly depending on the type of business you’re starting, as well as where you’re located.

For example, if you’re starting a freelance graphic design business in the U.S., you likely aren’t legally required to do anything if you want to operate as a ‘sole proprietor’ – that is, operating under your own name without an official business structure.

But if you’re starting a catering business in Florida, you’ll need to have items like:

- A food manager certification for at least one employee on your team

- Food handler permits for all team members

- An employer identification number (EIN) from the IRS

- A sales tax registration number from the Sales Tax Division of the Florida Department of Revenue

Pretty big difference, eh?

Let’s look at some legal aspects of what’s required to start a business in the U.S. and abroad.

How to start a business in the U.S.

Registering the business

As I mentioned above, if you’re doing business as ‘Jane Smith’ in the U.S., you don’t need to register. But if you want any other business name – even something like ‘Jane Smith Design’ – you have to register.

It’s worth noting though, that if your business ever gets sued, your own personal possessions will be at risk. That’s why many prefer to register a business name, so that the business itself is legally liable instead.

The Small Business Administration (SBA) has everything you need to know to register your business.

Paying federal, state, and local taxes

If your business will operate outside of a sole proprietorship, or if you’ll have any employees, you need to pay federal taxes every year. In order to do this, you’ll need to apply for an Employer Identification Number (EIN).

Learn more about EINs and how to get one on the SBA’s website.

You might also need to pay state and local taxes. These might include self-employment (for sole proprietors), payroll (if you have employees), sales, income, and property tax.

The SBA can tell you all about state and local taxes.

Opening a separate business bank account is also a good idea, especially for tax purposes. Keeping business finances separate from personal finances can save you a massive headache.

Business licenses and permits

As we discussed briefly, each business type has its own legal requirements – some more extensive than others. This is especially true for businesses that have heightened liability, like food service. The government steps in and takes several precautions to make sure the public is safe.

On top of this, your specific state, county, or city may also have additional requirements. Take some time to research where you’ll register and run your business. You’ll then be able to learn how to get business licenses and permits.

Learn more about federal and state licenses and permits from the SBA.

Business regulations and laws

Every business – no matter how big or small – must operate based on the same set of laws and regulations. These include marketing and advertising, finance, privacy, and intellectual property, laws.

Depending on your business structure, you’ll need to file certain forms, reports, and details to prove that you’re staying compliant with these laws.

[highlight]Surprise! The SBA has information for staying legally complaint.[/highlight]

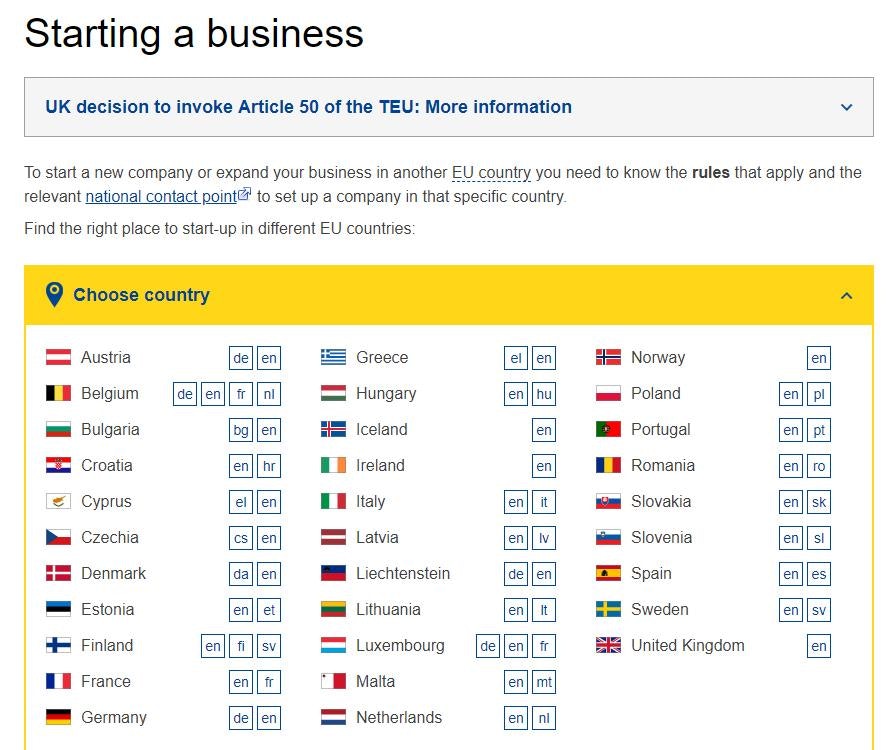

How to start a business outside of the U.S.

Obviously, your legal requirements for staying compliant with a business will vary with each country. Generally speaking, you should look to check off the same types of tasks and considerations as a U.S. business, such as:

- Registering based on your company type, business model, team structure, etc.

- Legal implications for having a team and managing employees

- Taxes and other financial requirements by country and region, if applicable

- The laws and regulations that apply to your business type – how to comply and continuously prove compliance

Here are some resources and tips for how to start a new business outside of the States.

The European Union’s website can guide you on starting a business in EU countries. Just select which country you’re in and go from there.

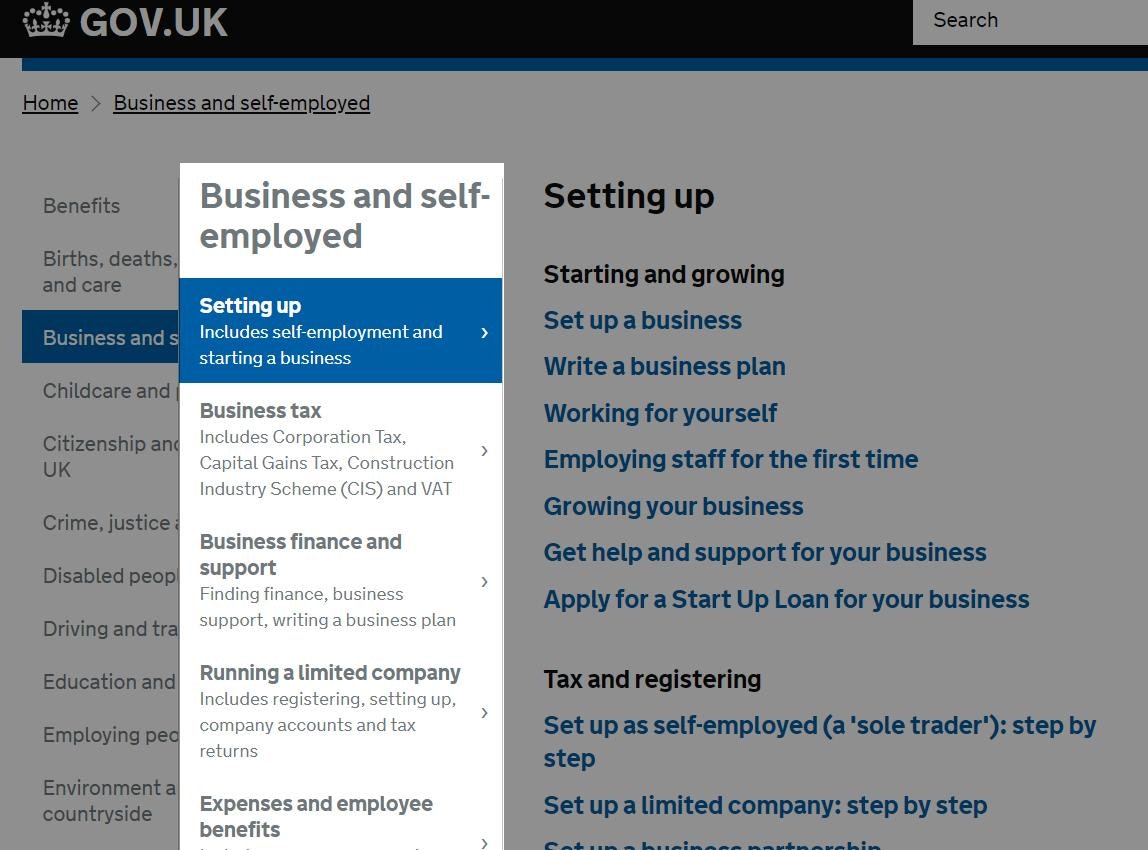

The UK Government’s site tells you all about starting a business in the UK.

I also recommend diving into some good old fashioned internet search. Try Googling phrases like:

- How to start a business in [your country]

- Laws for starting a business in [your country]

- Legal requirements to start a business in [your country]

- How to register a [type of business] business in [your country]

- Tax laws for [type of business] in [your country]

- Employer laws for [type of business] in [your country]

You get the point.

Of course, if you have any hesitations or discomfort managing this on your own, you can always seek a local business consultant or company to set you on the right path and answer all of your questions.

It’ll require an initial investment for these professional services, but it might be worth it considering the time and potential legal trouble it might save you in the future.

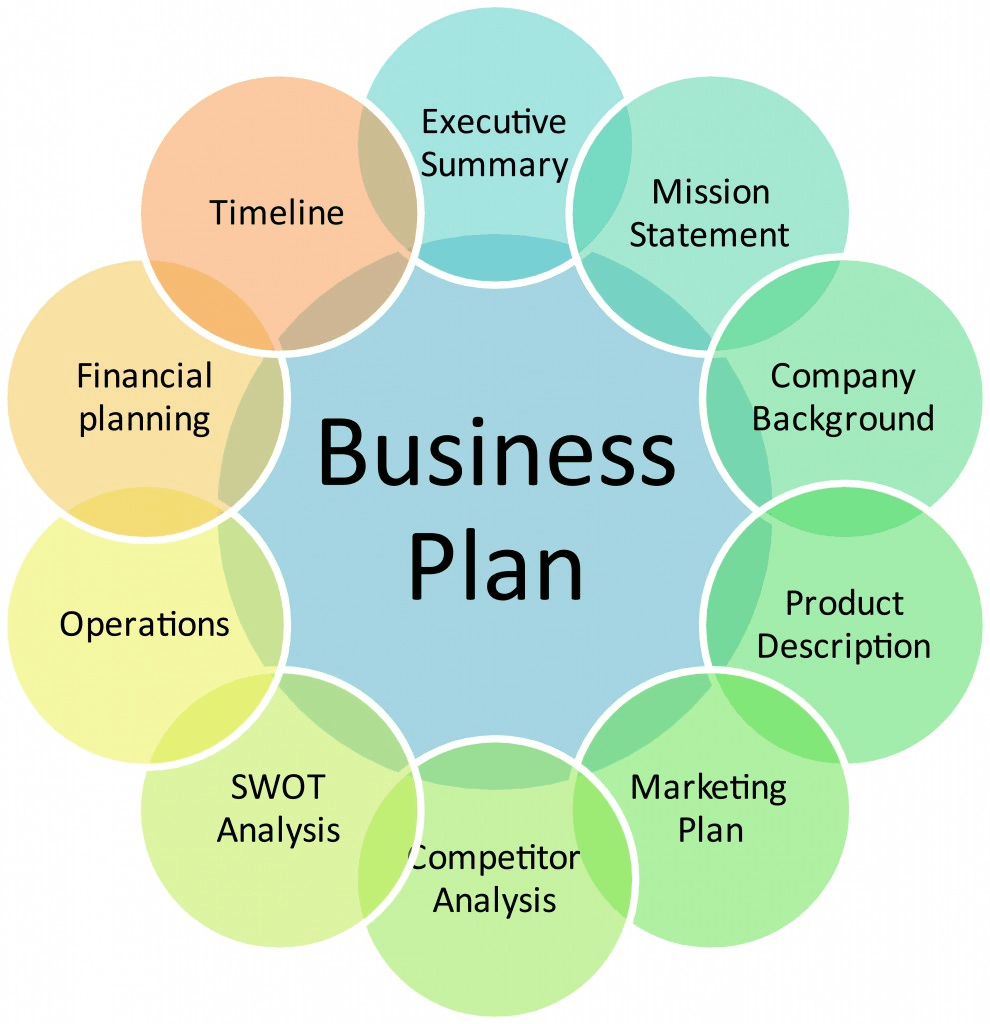

Writing a business plan

If you’re wondering how to start a business with no money, a business plan can be a critical step. It helped you to get attention and buy-in from financial stakeholders like partners, lenders, and investors.

Even if you’re starting small or bootstrapping, a business plan is a good idea for organizing your knowledge so far, solidifying your direction, and guiding your next steps.

Here are some key elements to include.

Executive summary

A high-level overview of what your business is all about. This typically includes what it does, how it works, the reason it exists, and the problems it will solve for its audience. You should include your mission statement and a basic description of the business model.

Business description

Go into detail about the business: the leadership who runs it and the problems it solves. Boast about your strengths as a company: what sets you apart from competitors? What fuels you? Also include your weaknesses or obstacles and your action plan for managing them. This is traditionally referred to as a SWOT analysis.

Market analysis

This is where you can include the research data you did earlier, when you identified problems that need solving. If you have any competitors, you should also include some information about these businesses and how they work. Show how you can do better than them.

Organization and management

Explain the structure and business model: what type of business it is, how it’s set up, and your future plans for what kind of legal structure it will have. If there are others on the team, introduce them and explain their key strengths and expertise. Consider including CVs or resumes.

Product or service

Go into detail about your company’s deliverables, or the products or services that you’ll sell to your final customers. If you have any research and development so far, include as much as possible. If you have any copyright or patent filings for your intellectual property, share those too.

Marketing and sales

No point in having a business if you don’t make any sales, right? Use this section to outline your marketing strategy. Keep in mind that a winning marketing strategy is comprehensive and ongoing – ideally, it will morph and evolve based on market changes and business growth.

You should absolutely invest in a good marketing strategy.

Marketing is a massive rabbit hole that we won’t dive into here. But what we will do is give you an awesome resource bank to keep in your pocket.

| Marketing Strategy | Examples | Resources |

| Content marketing | Blogs, ebooks, whitepapers, infographics, videos, webinars, podcasts, etc. | |

| Pay-per-click (PPC) |

| |

| Social media | Organic (unpaid) content on Facebook, Instagram, Pinterest, Snapchat, etc; influencer marketing; viral marketing | |

| Other tactics | Email marketing; referral marketing, relationship marketing, social responsibility marketing, inbound marketing, affiliate marketing, guerilla marketing, viral marketing | |

| [General strategy tips] | ||

Funding request

If you’re making this business plan to get a loan or investment, this part is important. Clearly outline the funding you envision your company needing over the course of the next five years, and how that funding will be allocated to juice up your company and accomplish your goals.

State if you want debt or equity, what kind of terms you want for the agreement, and how much time is covered by the funding request. Also, include your long-term financial plan, like how you’ll pay a loan back or if you plan to sell the company.

Financial projections

Tell the financial story of your business and sell it as a good investment. Give yearly, quarterly, or even monthly projections included forecasted income statements, cash flow statements, balance sheets, and capital expenditure budgets.

Match your funding request to your projections to show that the money will have purpose. If you have collateral to put against a loan, list it out here.

Phew. Now, you know which legal and financial considerations to look into as you set up your official business. And you’ve got some groundwork for writing a business plan that sells your idea to potential stakeholders (or at least keeps you in the right direction).

Next up: how to fund your business and handle finances #likeaboss.