US Mobile Payment Market (2018–2025)

With the ever-increasing number of smartphone users, it’s become vital for businesses to pay attention to mobile payments.

The latest figures show that the mobile payment market in the US has been growing in recent years and will continue to do so in the years to come.

This is especially so for proximity mobile payments and P2P (peer-to-peer) mobile payments, which are among the most mainstream mobile payment methods.

Don’t wait for someone else to do it. Hire yourself and start calling the shots.

Get Started FreeMobile Payment Market: Proximity Mobile Payment

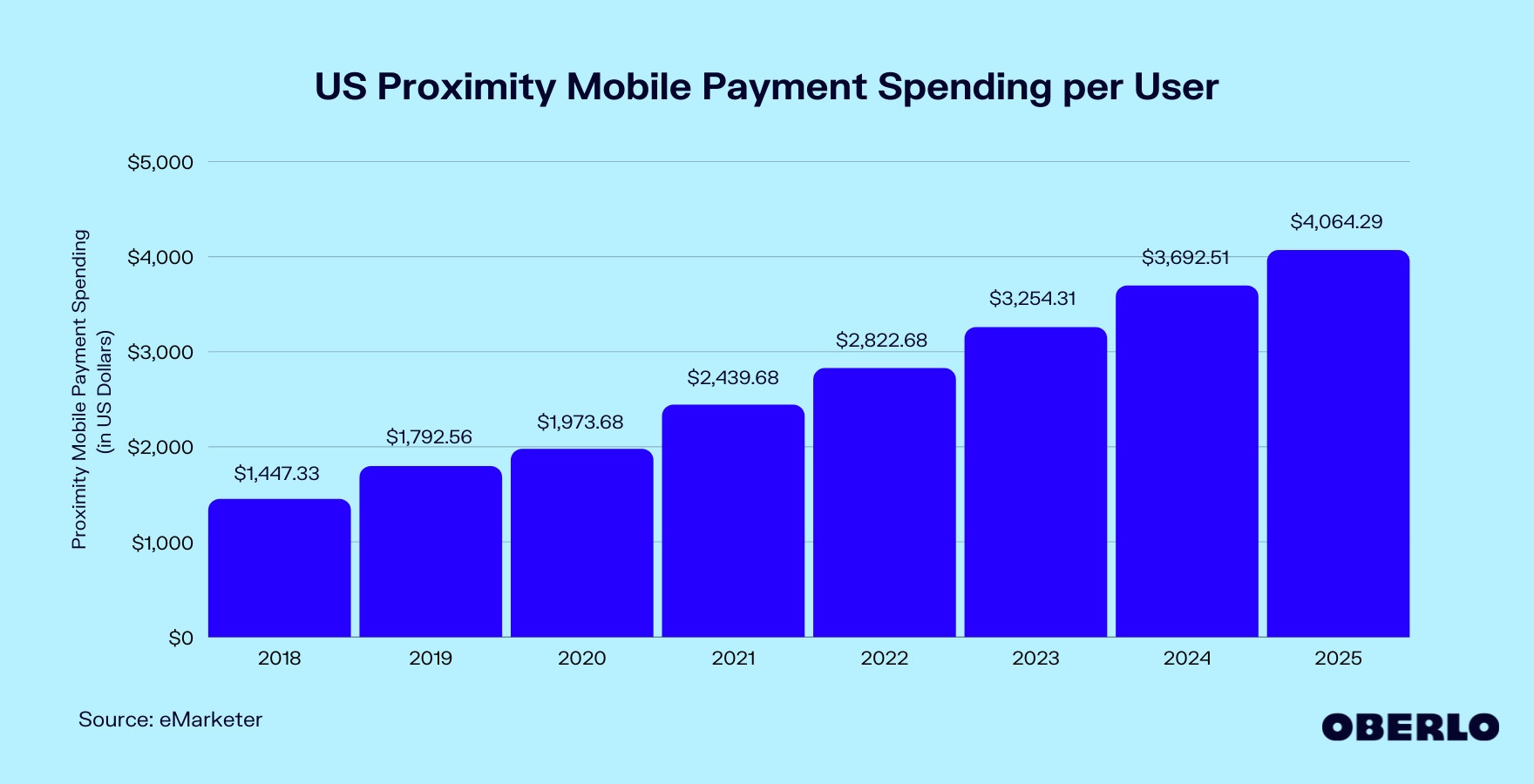

According to recent reports on the mobile payment industry in the US, proximity mobile payment spending per user is expected at $2,439.68 per mobile phone user. This is a 23.6 percent year-over-year increase from $1,973.68 in 2020.

Proximity mobile payments here refer to point-of-sale transactions carried out through mobile phones (excluding tablets) and can be anything from scanning and tapping to swiping a mobile phone to pay for a purchase.

Such payment methods have become increasingly popular in recent years. Its expenditure per user grew at an annual average of 29.5 percent from 2018 to 2021.

Though the value of goods purchased using proximity mobile payments per person is set to increase by over $1,600 from 2021 to exceed $4,000 in 2025, its growth is expected to slow. The average annual growth rate from 2022 to 2025 is forecast at 13.65 percent – less than half the growth rate of the preceding four years.

Mobile Payment Market: P2P Mobile Payment

P2P mobile payments have also been dominating the US mobile payment market.

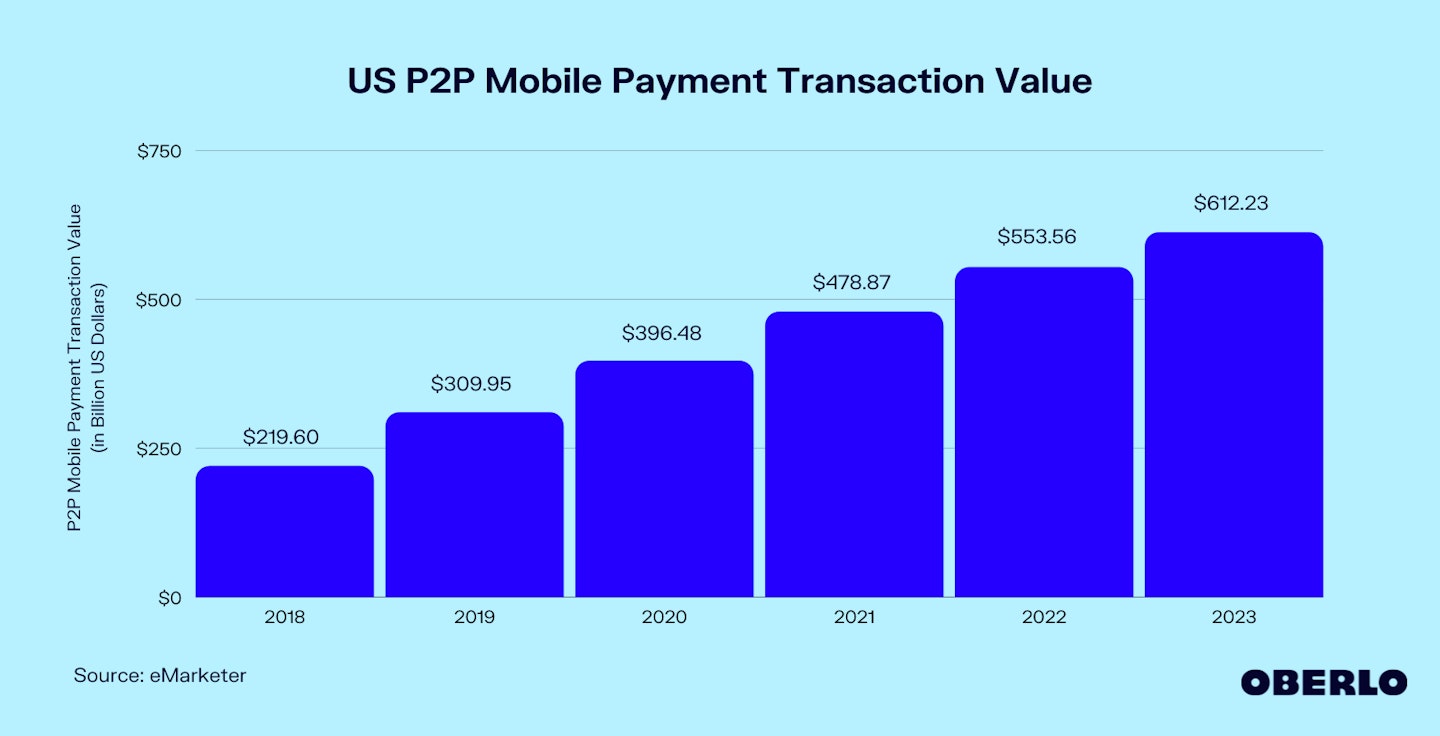

The total transaction value from P2P mobile payments is expected at $478.87 billion in 2021, 20.8 percent higher than in 2020.

The convenience of this payment method means analysts are expecting its transaction value to continue increasing in the coming years and reach $612.23 billion by 2023.

Mobile payment industry experts have credited the growing popularity of P2P mobile payments to three companies in particular, Venmo, Zelle, and Cash App, which they say are revolutionizing the market.

These three firms experienced unprecedented growth in 2020 as a result of the coronavirus pandemic and have had huge success in getting new users on board their P2P mobile payment service. In fact, analysts expect that all three companies will increase their user base over the next few years.